What makes a good trader?

17 JAN 2019 | Careers

Amir Khadr - Head of Technology

Managing Director, Will de Lucy: 'What makes a successful trader?' is a question I get asked often. Whilst no two traders are the same, there are habits and processes we can all follow to ensure our performance meets its potential' .

I have always thought that measuring how an individual reacts to the relentless stress, pressure and self-doubt created when making risk decisions for a living could create one of the most interesting studies of people. Managing performance over time is an incredibly personal journey and taking full responsibility for split-second decisions with huge financial consequences, can lead to an interesting discovery of self.

It is this self-awareness, and the ability for a trader to manage their mind-set through bleak periods of performance has always made the greatest impact I have seen both through my career, and through the management of 100’s of new traders at Amplify Trading.

To help our traders at Amplify better understand where their mind-set is at any point in time, I often refer to Daniel Kahneman’s Prospect Theory for which he won the Nobel prize in economics, in 2002. Kahnman’s theory was ground breaking at the time, because it examined why we as individuals do not always make wealth maximising decisions as neo-classical economic models would suggest.

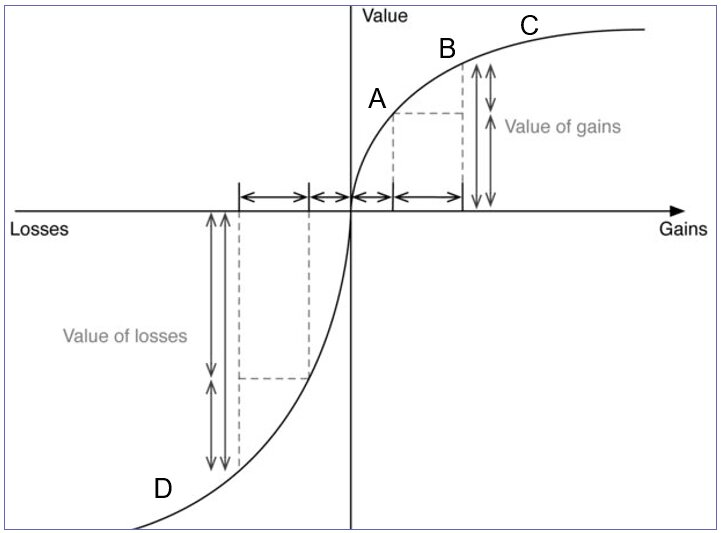

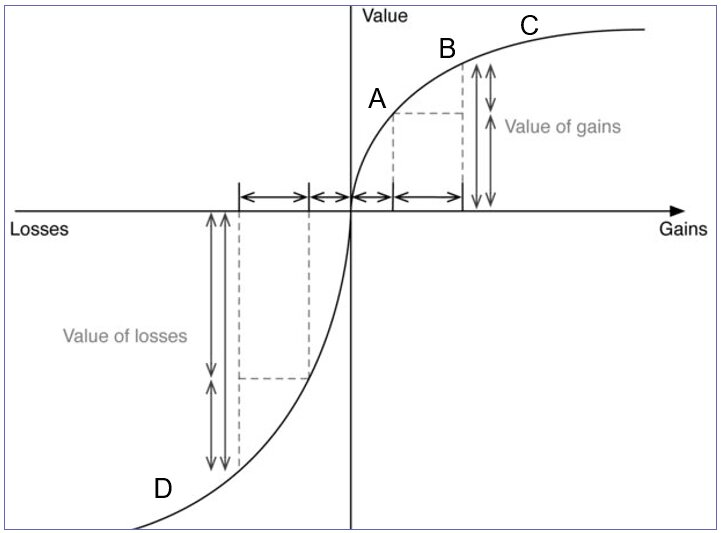

In the below chart, you can see how an individual responds to a change in the value of their gains. The higher on the y axis, the more content the individual, and the lower on the y axis, the more dissatisfied. The y axis simply reflects gains and loss. What is crucial to understand is how a trader feels about their performance, a monetary amount, depends on how their performance compares to what they expected their performance to be. So, for example, if a trader was expecting to make $2000 and they in-fact made $4000 they would feel good (A). If that trader then made $8000 they would feel even better about their performance (B), however at point C at $16000 they do not materially feel that different to when at point B. This means the $8000 between point B and C is worth less to that trader, it has less of an impact on how they feel, when compared to the first $8000 between the axis and point B.

I have always thought that measuring how an individual reacts to the relentless stress, pressure and self-doubt created when making risk decisions for a living could create one of the most interesting studies of people. Managing performance over time is an incredibly personal journey and taking full responsibility for split-second decisions with huge financial consequences, can lead to an interesting discovery of self.

It is this self-awareness, and the ability for a trader to manage their mind-set through bleak periods of performance has always made the greatest impact I have seen both through my career, and through the management of 100’s of new traders at Amplify Trading.

To help our traders at Amplify better understand where their mind-set is at any point in time, I often refer to Daniel Kahneman’s Prospect Theory for which he won the Nobel prize in economics, in 2002. Kahnman’s theory was ground breaking at the time, because it examined why we as individuals do not always make wealth maximising decisions as neo-classical economic models would suggest.

In the below chart, you can see how an individual responds to a change in the value of their gains. The higher on the y axis, the more content the individual, and the lower on the y axis, the more dissatisfied. The y axis simply reflects gains and loss. What is crucial to understand is how a trader feels about their performance, a monetary amount, depends on how their performance compares to what they expected their performance to be. So, for example, if a trader was expecting to make $2000 and they in-fact made $4000 they would feel good (A). If that trader then made $8000 they would feel even better about their performance (B), however at point C at $16000 they do not materially feel that different to when at point B. This means the $8000 between point B and C is worth less to that trader, it has less of an impact on how they feel, when compared to the first $8000 between the axis and point B.

This is interesting because it means a trader may make a different decision when faced with a market opportunity if they are at point C or A. When at point C any further gains will not impact how the trader feels so they will be more likely to get out of profitable positions, or not take any further risk. You can see the line to the left of point C is steeper which means the trader will have more to lose emotionally by taking a risk decision that goes wrong, then if it works out.

On the left of the chart the line is much steeper still, which points to the fact that loses are felt more aggressively than gains. Traders like to punish themselves more quickly for poor performance than reward themselves for a positive one. It is when a trader reaches point D that the difference between a good trader and a bad trader can be seen more clearly than at any other time.

At Amplify how a trader responds at point D is something we measure incredibly closely, we call it variance resilience. How does execution after a shock event (or poor period of performance) change compared to execution before that shock? Put simply, if a trader has taken a loss that is significant to them, are they able to remain focussed and competent, and take the next trading decision as if that shock event has never happened. Or, as described so well by Steve Peters Chimp Paradox, does the trader allow their inner chimp to now make emotional decisions that further impacts their trading performance.

The emotional response at point D will have the greatest impact on the future success of that trader. A trader that allows their ‘inner chimp’ to now dictate their actions may start at this point to revenge trade, withdraw or refuse to let go. All of these will not only harm their performance for that day or trade, but more importantly can change the track of progression for that trader, leading to a very different future performance. It is possible to see this happen to professional athletes where a shock event (think Tiger Woods or Novak Djokovic) hits performance not only for the next game but that poor performance itself then leads to a spiral of defeats. This in turn damages the self-confidence needed to perform at the peak of their ability.

If left un-checked a trader will then move to the left of point D on the chart, where the curve begins to flatten, and no further loss in money seems to matter. This is when a trader will do themselves the most possible damage. They will risk all they can because in terms of how they feel, it cannot get any worse. Reaching this point is probably the single most prevalent reason to explain why most new traders fail.

However, a good trader will be able to recognise both physical and mental signs that highlight the fact they are in an emotional state, which could lead them to making poor decisions of risk. So much of this is subconscious, and therefore difficult to measure and manage. For example, it may be that their breathing pattern changes, or they start to hunch over their desk. It may be that they keep on checking the market after having been stopped out of a position, unable to move on from a feeling that the market has treated them unfairly.

Most importantly however, a good trader will have the will power and discipline to then act on what these signals are telling them. They would have trained themselves to refresh their mind-set when it is most important to do so, and re-focus on the market opportunity. They will not allow what happened in the previous trade, or even previous day or week, impact on the next decision they make. A good trader can compartmentalise their experiences to always act in a way that increases the probability of the next trade being a successful one.

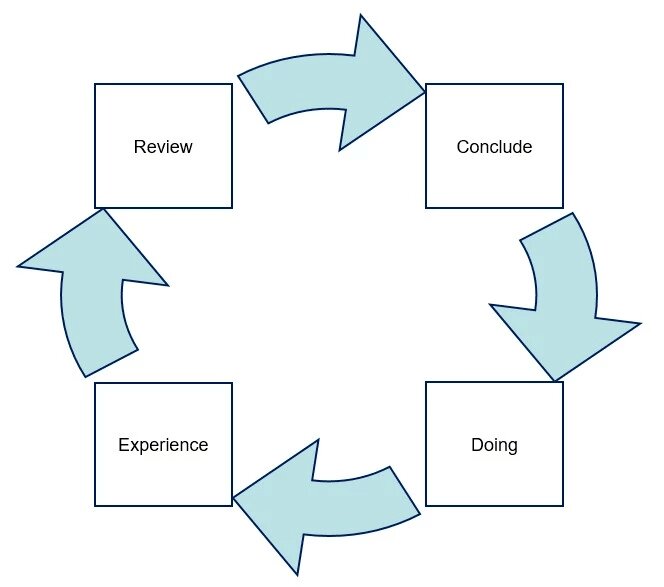

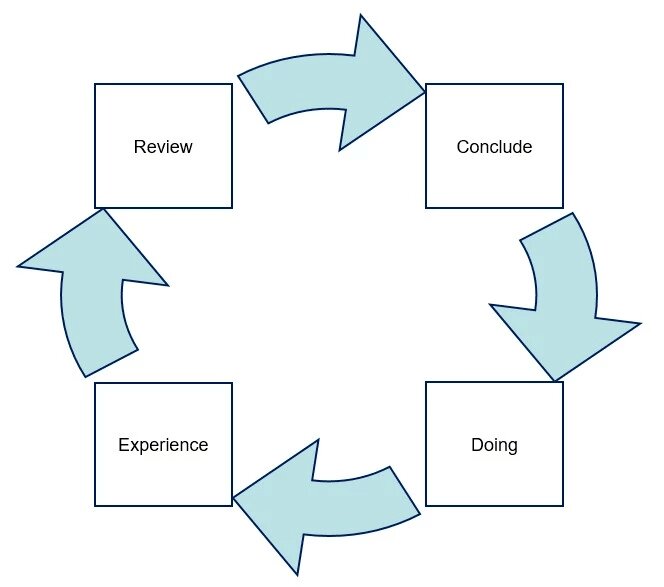

To try and ensure this mind-set at Amplify Trading we stress the importance of continuous improvement so traders can learn after each experience, to then be better prepared for the next trade ahead of them. Using Kolb’s cycle (below) it can be shown that no experience should be wasted, everything a trader does should be reviewed and thought through, to further enhance the profitability of the next trading experience. Not only are the markets always changing, but so is our interaction within them, and a losing trade, reviewed properly, can actually be one of the most valuable experiences a trader can have.

On the left of the chart the line is much steeper still, which points to the fact that loses are felt more aggressively than gains. Traders like to punish themselves more quickly for poor performance than reward themselves for a positive one. It is when a trader reaches point D that the difference between a good trader and a bad trader can be seen more clearly than at any other time.

At Amplify how a trader responds at point D is something we measure incredibly closely, we call it variance resilience. How does execution after a shock event (or poor period of performance) change compared to execution before that shock? Put simply, if a trader has taken a loss that is significant to them, are they able to remain focussed and competent, and take the next trading decision as if that shock event has never happened. Or, as described so well by Steve Peters Chimp Paradox, does the trader allow their inner chimp to now make emotional decisions that further impacts their trading performance.

The emotional response at point D will have the greatest impact on the future success of that trader. A trader that allows their ‘inner chimp’ to now dictate their actions may start at this point to revenge trade, withdraw or refuse to let go. All of these will not only harm their performance for that day or trade, but more importantly can change the track of progression for that trader, leading to a very different future performance. It is possible to see this happen to professional athletes where a shock event (think Tiger Woods or Novak Djokovic) hits performance not only for the next game but that poor performance itself then leads to a spiral of defeats. This in turn damages the self-confidence needed to perform at the peak of their ability.

If left un-checked a trader will then move to the left of point D on the chart, where the curve begins to flatten, and no further loss in money seems to matter. This is when a trader will do themselves the most possible damage. They will risk all they can because in terms of how they feel, it cannot get any worse. Reaching this point is probably the single most prevalent reason to explain why most new traders fail.

However, a good trader will be able to recognise both physical and mental signs that highlight the fact they are in an emotional state, which could lead them to making poor decisions of risk. So much of this is subconscious, and therefore difficult to measure and manage. For example, it may be that their breathing pattern changes, or they start to hunch over their desk. It may be that they keep on checking the market after having been stopped out of a position, unable to move on from a feeling that the market has treated them unfairly.

Most importantly however, a good trader will have the will power and discipline to then act on what these signals are telling them. They would have trained themselves to refresh their mind-set when it is most important to do so, and re-focus on the market opportunity. They will not allow what happened in the previous trade, or even previous day or week, impact on the next decision they make. A good trader can compartmentalise their experiences to always act in a way that increases the probability of the next trade being a successful one.

To try and ensure this mind-set at Amplify Trading we stress the importance of continuous improvement so traders can learn after each experience, to then be better prepared for the next trade ahead of them. Using Kolb’s cycle (below) it can be shown that no experience should be wasted, everything a trader does should be reviewed and thought through, to further enhance the profitability of the next trading experience. Not only are the markets always changing, but so is our interaction within them, and a losing trade, reviewed properly, can actually be one of the most valuable experiences a trader can have.

Reflection is incredibly important, and the best traders are aware of how their psychology is something the needs constant training and development. I deliver trading psychology sessions to some of the largest asset managers in London and New York, all of whom are humble enough to appreciate how vulnerable they are.

Intelligence and ability does not separate the successful or unsuccessful trader. The biggest difference between the former and the later, is the ability to always maintain focus and composure through awareness of self.

Intelligence and ability does not separate the successful or unsuccessful trader. The biggest difference between the former and the later, is the ability to always maintain focus and composure through awareness of self.

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.