Before we delve into Ethereum, let's start with what is Quantative Analysis?

Quantitative analysis (QA) is a technique that uses mathematical and statistical modeling, measurement, and research to understand behavior.

This method has seen increased adoption in recent years through further technological innovation as firms like Citadel and Jane Street Capital look to hire graduates who typically have the following skill sets:

- Strong abilities in mathematics & statistics

- Solid skills in data mining & data analysis

- Extensive financial knowledge

So how is this applied to a cryptocurrency?The team at

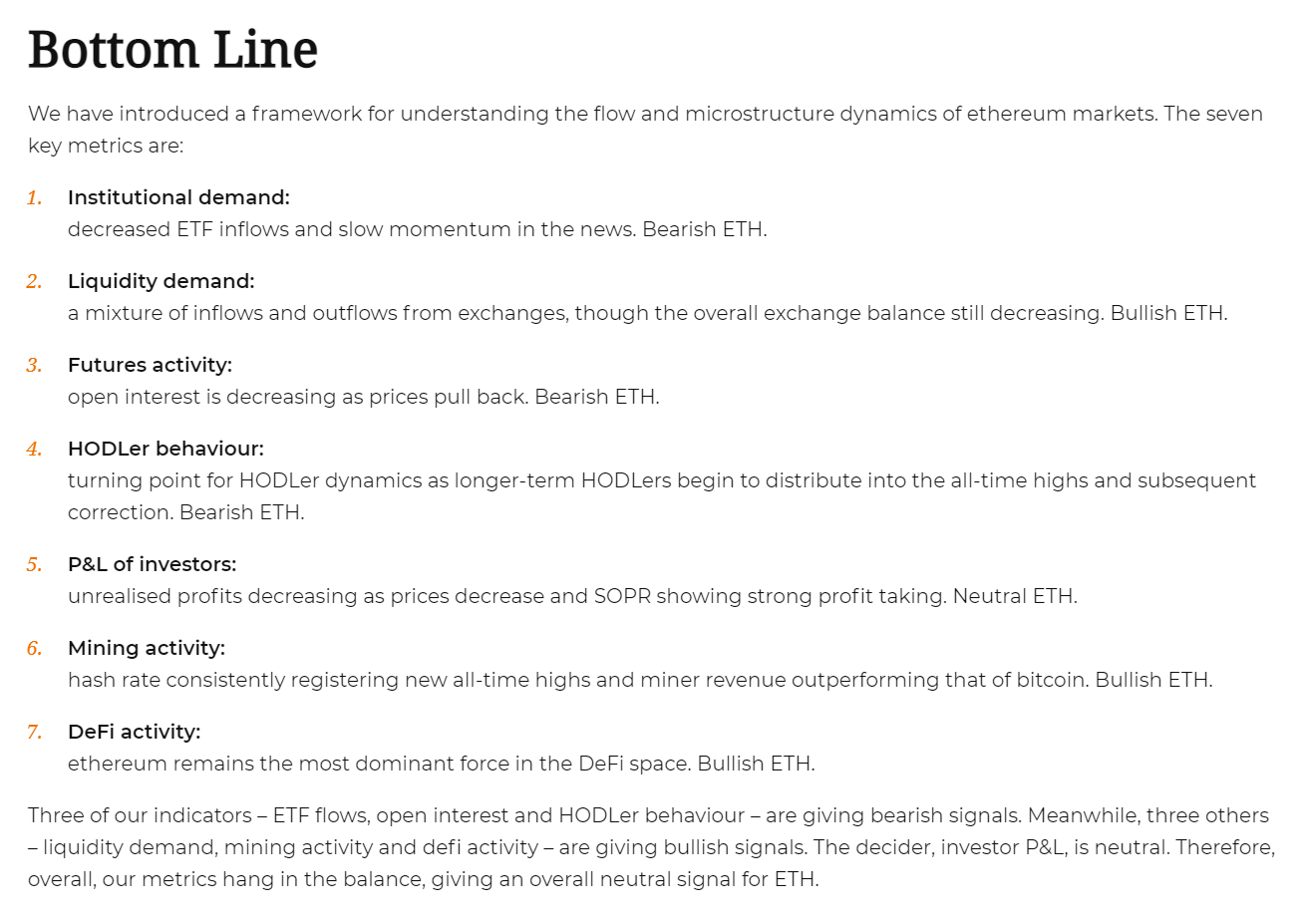

Macro Hive, led by Bilal Hafeez, the former global Head of Research at Deutsche and Nomura, have introduced a framework for understanding the flow and microstructure dynamics of ethereum markets.

They break this down into 7 key metrics, which then create a bullish, bearish or neutral signal.

As of 24th November 2021, their team maintained a structural bullish view but are cautious in the short term. They note to watch HODLer behaviour, hash rates and DeFi activity trends to get a clearer signal for calling the end of the correction.

Here are the 7 metrics decontructed