NFP and the Dovish Dip Buyers

02 SEP 2020 | Careers

Summary

NFP

Consensus is for 1.55mln to be added to non-farm payrolls in August - a slower pace than July's +1.76mln. Covid cases in the US peaked in late July, and with the July reading printing solidly, this put to bed any worries that the resurgence in cases was going to impact employment and slow the economic recovery. With covid cases on the decline over recent weeks, the employment situation should continue to improve, reflecting analyst expectations.

Initial jobless claims have continued to trend lower throughout August along with continuing claims. PMI sub-indices have moved higher. It's likely that a downside surprise is limited given the high frequency data points, but analyst expectations are still enormously wide. ING’s base case is for a below consensus print, while Capital Economics forecast is more bullish.

The range of analysts’ expectations is 750k on the lower end, up to 2mn on the higher end of the spectrum, reflecting a still deeply varied range of estimates. Any reading that falls outside of these lower/higher ranges will have more market impact. Of course, that's going to be difficult.

- Non-Farm Payrolls is unlikely to change the macro landscape of the dovish major trend and over-stretched positioning in the near-term.

- EURUSD rejects major resistance around 1.2000 with eager dovish dip buyers lurking.

- ECB expresses concerns about the current strength of the Euro, with the ECB meeting on 10th-September.

NFP

Consensus is for 1.55mln to be added to non-farm payrolls in August - a slower pace than July's +1.76mln. Covid cases in the US peaked in late July, and with the July reading printing solidly, this put to bed any worries that the resurgence in cases was going to impact employment and slow the economic recovery. With covid cases on the decline over recent weeks, the employment situation should continue to improve, reflecting analyst expectations.

Initial jobless claims have continued to trend lower throughout August along with continuing claims. PMI sub-indices have moved higher. It's likely that a downside surprise is limited given the high frequency data points, but analyst expectations are still enormously wide. ING’s base case is for a below consensus print, while Capital Economics forecast is more bullish.

The range of analysts’ expectations is 750k on the lower end, up to 2mn on the higher end of the spectrum, reflecting a still deeply varied range of estimates. Any reading that falls outside of these lower/higher ranges will have more market impact. Of course, that's going to be difficult.

The unemployment rate should remain roughly unchanged, likely a touch lower. Also, remember that as the recovery has been underway for quite some time now, a slowdown in the pace of job growth is to be expected but that's a healthy sign. At first glimpse, 1.4mn vs prev 1.76mn may look bad but it’s important to take the overall picture in to consideration.

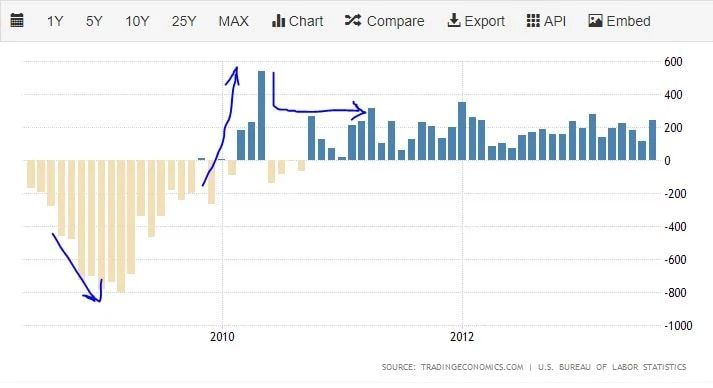

Looking at the NFP from the 2008 recession, it's clear there are three stages to the post-recession pace of job growth:

Therefore, it is normal to see the pace of job growth slow after a sharp recovery.

Amir Khadr - Head of TechnologyLooking at the NFP from the 2008 recession, it's clear there are three stages to the post-recession pace of job growth:

- Mass unemployment as the economy shrinks

- A sharp recovery in employment

- The pace of recovery slows and becomes more consistent with historical averages.

Therefore, it is normal to see the pace of job growth slow after a sharp recovery.

The only difference in 2020 post recession is the speed of the recession and the depth of unemployment. But on a macro basis, what's happening here is normal. The only real risk of course is a resurgence of covid, which seems to of peaked in late July. Now in the coming months, the pace of job growth may slow, or even turn negative, on the longer timeframe is likely to stabilize back towards the normal mean, towards the 200k mark.

Trading

TThink trades could be disappointed, as I personally don't believe employment situation is the current driving theme. So unless the print falls outside of analyst expectations then may not be much movement.

On Tuesday-01st September was a stronger ISM non-manufacturing print, which saw the USD strengthen. This was likely due to positioning, an unwind of USD short positions rather than related to the report itself.

Positioning

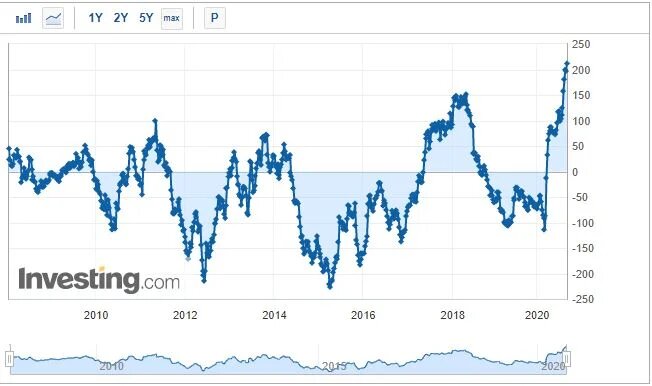

Positioning across the dovish trend is extremely stretched, with EUR/USD long positioning now higher than in 2017 during Macron's rally. Price has rallied almost 13% in 24 weeks from low to high since March, without much in the ways of a retracement. In 2018 price rallied almost 17% in 37 weeks, including the consolidation prior to the rally.

Price is testing the 1.2000 mark, July'12 low, which is solid resistance, in recent weeks the rally has been losing steam first around 1.1900 and now 1.2000. All this makes the EUR/USD vulnerable to a correction lower in the near term, towards 1.1750/00.

TThink trades could be disappointed, as I personally don't believe employment situation is the current driving theme. So unless the print falls outside of analyst expectations then may not be much movement.

On Tuesday-01st September was a stronger ISM non-manufacturing print, which saw the USD strengthen. This was likely due to positioning, an unwind of USD short positions rather than related to the report itself.

Positioning

Positioning across the dovish trend is extremely stretched, with EUR/USD long positioning now higher than in 2017 during Macron's rally. Price has rallied almost 13% in 24 weeks from low to high since March, without much in the ways of a retracement. In 2018 price rallied almost 17% in 37 weeks, including the consolidation prior to the rally.

Price is testing the 1.2000 mark, July'12 low, which is solid resistance, in recent weeks the rally has been losing steam first around 1.1900 and now 1.2000. All this makes the EUR/USD vulnerable to a correction lower in the near term, towards 1.1750/00.

Chart below illustrates the points made above on the price chart. Additionally, the weekly stochastics, measure of overbought/ oversold conditions, is near the highs printed at the end of the major up-leg in 2017. This simply indicates overbought conditions in the near-term

ECB

Phillip Lane, Chief Economist at the ECB piped up yesterday saying: "the ECB has an inflation mandate and we care about the overall performance of the European economy"..."We've seen a repricing in recent weeks to some degree [of the EUR/USD fx rate]". Expressing that the exchange rate is important to the ECB's policy decisions. This is the first verbal intervention from the ECB expressing their concern with a sharply higher euro.

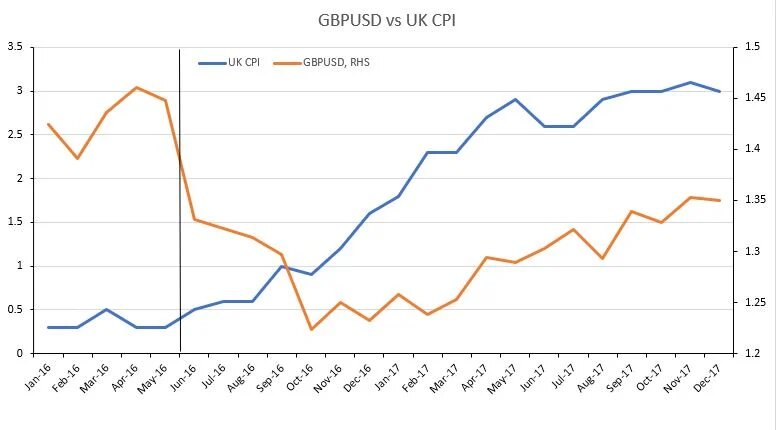

Currencies and inflation are linked, when a currency depreciates, as post Brexit in 2016, inflation rose over the subsequent quarters with a delayed effect, and as the currency began to recover inflation then peaked around 3.00%. As shown below:

Phillip Lane, Chief Economist at the ECB piped up yesterday saying: "the ECB has an inflation mandate and we care about the overall performance of the European economy"..."We've seen a repricing in recent weeks to some degree [of the EUR/USD fx rate]". Expressing that the exchange rate is important to the ECB's policy decisions. This is the first verbal intervention from the ECB expressing their concern with a sharply higher euro.

Currencies and inflation are linked, when a currency depreciates, as post Brexit in 2016, inflation rose over the subsequent quarters with a delayed effect, and as the currency began to recover inflation then peaked around 3.00%. As shown below:

When a currency falls significantly, it forces up import prices which causes inflation, and makes the country's exports cheaper which is good exporters.

In the case of Europe, inflation has been falling since late-2018, and now inflation is below zero and continuing to fall. This presents a problem for the ECB whose mandate is for inflation "below, but close to 2.00%". The ECB would rather a weaker currency to help boost inflation, but have the opposite. So what do they do?

A sharp 12% appreciation the euro during a time when Europe is trying to recover from post-covid recession will put the breaks on inflation. This is why ECB's Lane talk down the euro at the 1.2000 mark on Tuesday, and will certainly be interesting to hear what they say on the 10th-September meeting about the current value of the EURUSD, and importantly how they plan to deal with it.

Growth and inflation forecasts will likely be lowered as the previous forecasts were issued when eurusd traded 1.1000 back in may, well the currency is now trading near 1.2000. Lower inflation forecasts may force the ECB to implement more PEPP, which previously had a positive impact on the euro. So how does the ECB boost inflation while keeping the euro low when the reason the euro is higher is due to the "reflation trade and negative real yields".

How will it affect prices?

All in all, the NFP doesn't change the current narrative. If it's worse than expected then this strengthens the Fed's dovish view "to do whatever it takes" to support the economy. If it's better then expected the fed will remain on it's current path, with many more tools left to be unveiled in the future.

So the dovish major trend set to continue in the medium term, although due to over-extended nature of positioning and concern from the ECB about the current level in the EURUSD, price currently rejecting resistance on the 1.2000 mark and support near the 1.1700 mark for the time being. 1.2000 being a tough nut to crack, but of course if price was to breakout over 1.2000 with conviction would be more bullish, but below 1.2000 more bearish down towards major support. Would expect the eagar dovish dip buyers to buy the EURUSD 1.1750s.

In the case of Europe, inflation has been falling since late-2018, and now inflation is below zero and continuing to fall. This presents a problem for the ECB whose mandate is for inflation "below, but close to 2.00%". The ECB would rather a weaker currency to help boost inflation, but have the opposite. So what do they do?

A sharp 12% appreciation the euro during a time when Europe is trying to recover from post-covid recession will put the breaks on inflation. This is why ECB's Lane talk down the euro at the 1.2000 mark on Tuesday, and will certainly be interesting to hear what they say on the 10th-September meeting about the current value of the EURUSD, and importantly how they plan to deal with it.

Growth and inflation forecasts will likely be lowered as the previous forecasts were issued when eurusd traded 1.1000 back in may, well the currency is now trading near 1.2000. Lower inflation forecasts may force the ECB to implement more PEPP, which previously had a positive impact on the euro. So how does the ECB boost inflation while keeping the euro low when the reason the euro is higher is due to the "reflation trade and negative real yields".

How will it affect prices?

All in all, the NFP doesn't change the current narrative. If it's worse than expected then this strengthens the Fed's dovish view "to do whatever it takes" to support the economy. If it's better then expected the fed will remain on it's current path, with many more tools left to be unveiled in the future.

So the dovish major trend set to continue in the medium term, although due to over-extended nature of positioning and concern from the ECB about the current level in the EURUSD, price currently rejecting resistance on the 1.2000 mark and support near the 1.1700 mark for the time being. 1.2000 being a tough nut to crack, but of course if price was to breakout over 1.2000 with conviction would be more bullish, but below 1.2000 more bearish down towards major support. Would expect the eagar dovish dip buyers to buy the EURUSD 1.1750s.

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.