MACRO MENU: 4 - 8 MAY 2020

THE LOCKDOWN ROADMAP

-

Protect the NHS's ability to cope and be confident that the NHS is able to provide sufficient critical care across the UK

-

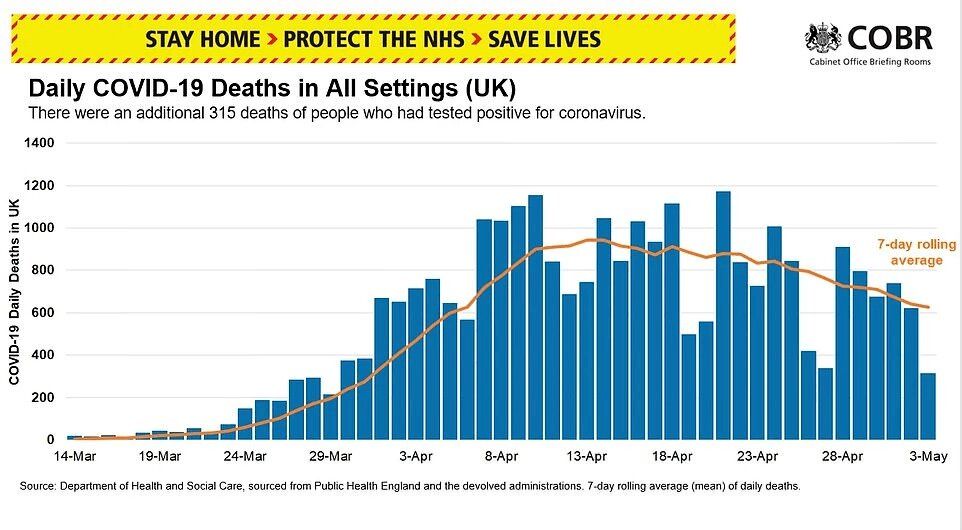

See a sustained and consistent fall in daily death rates to be confident the UK is beyond the peak

-

Reliable data from Sage showing rate of infection is decreasing to manageable levels across the board

-

Confident that testing capacity and PPE are in hand with supply able to meet future demand

-

Confident that any adjustments to the current measures would not risk a second peak in infections which would overwhelm the NHS

The Guardian has reported that work start times for the public could be staggered and the Sunday Times suggests that keeping passengers 2m apart in line with social distancing rules would leave commuter trains with only 15% of their usual capacity when lockdown rules are relaxed.

From a market perspective I would not anticipate any impact intraday upon the statement but the reality of normalising post a pandemic, for both businesses and people's lives, will be a gradual process at best.

The main things I am focusing on are:

-

The shape and severity of a second wave upon re-opening

-

The implementation of large scale testing to better monitor and control any secondary breakouts

-

Whether governments can continue to support the economy over the longer-term

For the government, the period ahead is an uncertain one but with the marketing machine in full speed to keep the general public on side you can expect an update to the 'Stay Home, Protect The NHS, Save Lives' slogan to something more symbolic of public unity in tackling the virus as one nation. How long Boris can maintain control as summer approaches is yet to be seen.

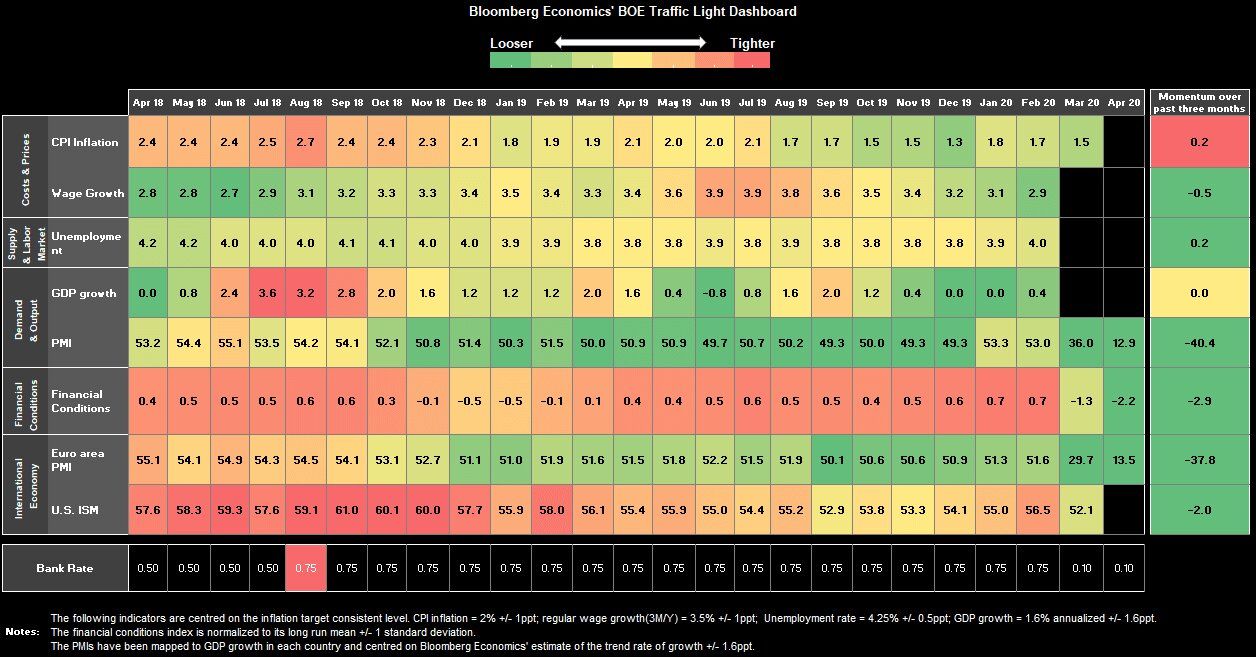

The Bank of England interest rate decision will be announced at the earlier time of 0700BST on Thursday (normally midday) in order to accommodate the joint publication with the interim Financial Stability Report. In addition to this, we will also see the new economic forecasts in the Quarterly Monetary Policy Report followed by the new governor Andrew Bailey briefing reporters after the decision with the contents of those discussions made public at 1000BST.

In summary, I'm not expecting a great deal of action as in a similar vein to the Fed and ECB last week a number of policy moves have already been taken inter-meeting and with a wide degree of uncertainty about the economic future due to the lack of clarity in future pandemic developments, I doubt market participants will read too much into the Bank's latest projections.

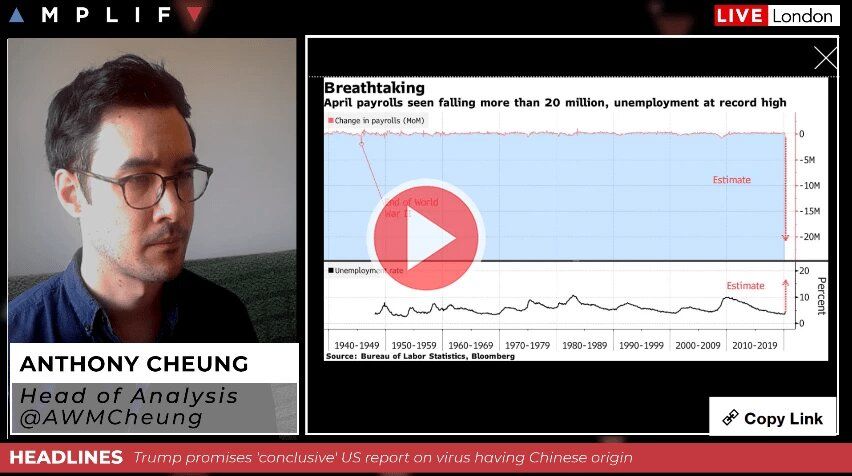

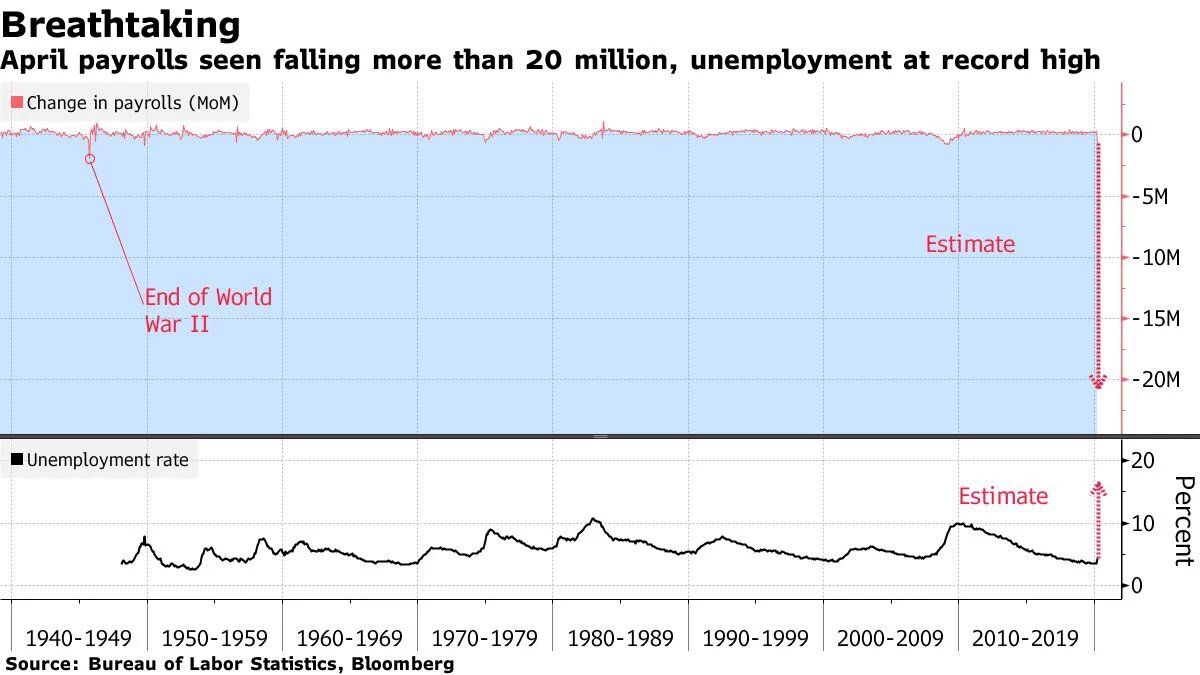

The latest change in US Non-Farm Payrolls will likely dominate the headlines of mainstream media across the world on Friday. Expectations are for a reading of -21mln (range low -28mln, high -2.5mln) with the Unemployment Rate surging to 14.0% (low 5.1%, high 21.0%).

The numbers don't make for pleasant reading but the reality for markets is that this news is now fully priced in, so unless the figure severely breaches the most pessimistic range then it's unlikely to be a game changer for investor perception short-term.

Given this harsh economic reality I would be anticipating more fiscal pledges from the US administration and would not be surprised to hear President Trump ramp up his anti-China rhetoric in an attempt to deflect attention away from the dire domestic situation.

EARNINGS SEASON CONTINUES

148 companies in the S&P 500 are due to report this week, including 2/30 DJIA components. A table of the most anticipated US names can be found below via Earnings Whispers.

- Tue: Total, BNP Paribas, Fiat Chrysler, Unicredit

- Wed: BMW, Credit Agricole, SocGen

- Thur: ArcelorMittal

- Fri: Siemens

Monday: JN/CN Holiday, AU NIA New Home Sales, MI Inflation Gauge, Building Approvals, SP/IT/FR/GE/EU Manufacturing PMI (F), EU Sentix Investor Confidence, PSPP Update, US ISM NY Index, Factory Orders. Durable Goods (R)

Tuesday: JN Holiday, AU RBA Interest Rate Decision, Services PMI, ANZ Commodity Price Index, FR Govt Budget Balance, SP Employment Change, Consumer Confidence, GE Constitutional Court Verdict on ECB QE, EU PPI, UK Services PMI, Construction PMI, US Trade Balance, Services PMI, IBD/TIPP Economic Optimism, ISM Non-Manufacturing PMI, CA Trade Balance, Weekly API Inventories, NZ GDT Price Index, Fed's Bostic, Bullard, Evans, George, ECB's Mersch Speak, UK/US Trade Talks

Wednesday: JN Holiday, CN Caixin Services PMI, AU Retail Sales, NZ Unemployment Rate, Employment Change, Labour Cost Index, IT/SP/FR/GE/EU Services PMI (F), GE Factory Orders, 5-yr Auction, US ADP Employment Change, Weekly DoE Inventories, Fed's George, Bostic Speak

Thursday: JN BoJ Minutes, CN Trade Balance, AU Trade Balance, NZ Inflation Expectations, FR Trade Balance, Current Account, Industrial Production, Non-Farm Payrolls, IT Retail Sales, SP 3/5/10-yr Auction, FR 10-yr Auction, EU Commission Economic Forecasts, UK BoE Interest Rate Decision, Financial Stability Report, Monetary Policy Report, Halifax House Price Index, UK Govt Lockdown Update, US Challenger Job Cuts, Weekly Jobless Claims, Non-Farm Productivity, Unit labour Costs, Consumer Credit, CA Ivey PMI, Fed's George, Harker Speak

Friday: UK Holiday, GfK Consumer Confidence, JN Services PMI, AU RBA Policy Statement, GE Trade Balance, SP Industrial Production, US Change in Non-Farm Payrolls, Unemployment Rate, Average Hourly Earnings, Wholesale Inventories/Sales, CA Unemployment Rate, Employment Change, Fed's George

You can find out more information about Amplify Trading HERE.

Have a good week ahead and stay safe.

Anthony Cheung

Head of Market Analysis

(@AWMCheung)

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

EMPLOYERS

UNIVERSITIES

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com