MACRO MENU: 22 - 26 JUNE 2020

22 JUN 2020 | Careers

Amir Khadr - Head of Technology

COVID-19 status check

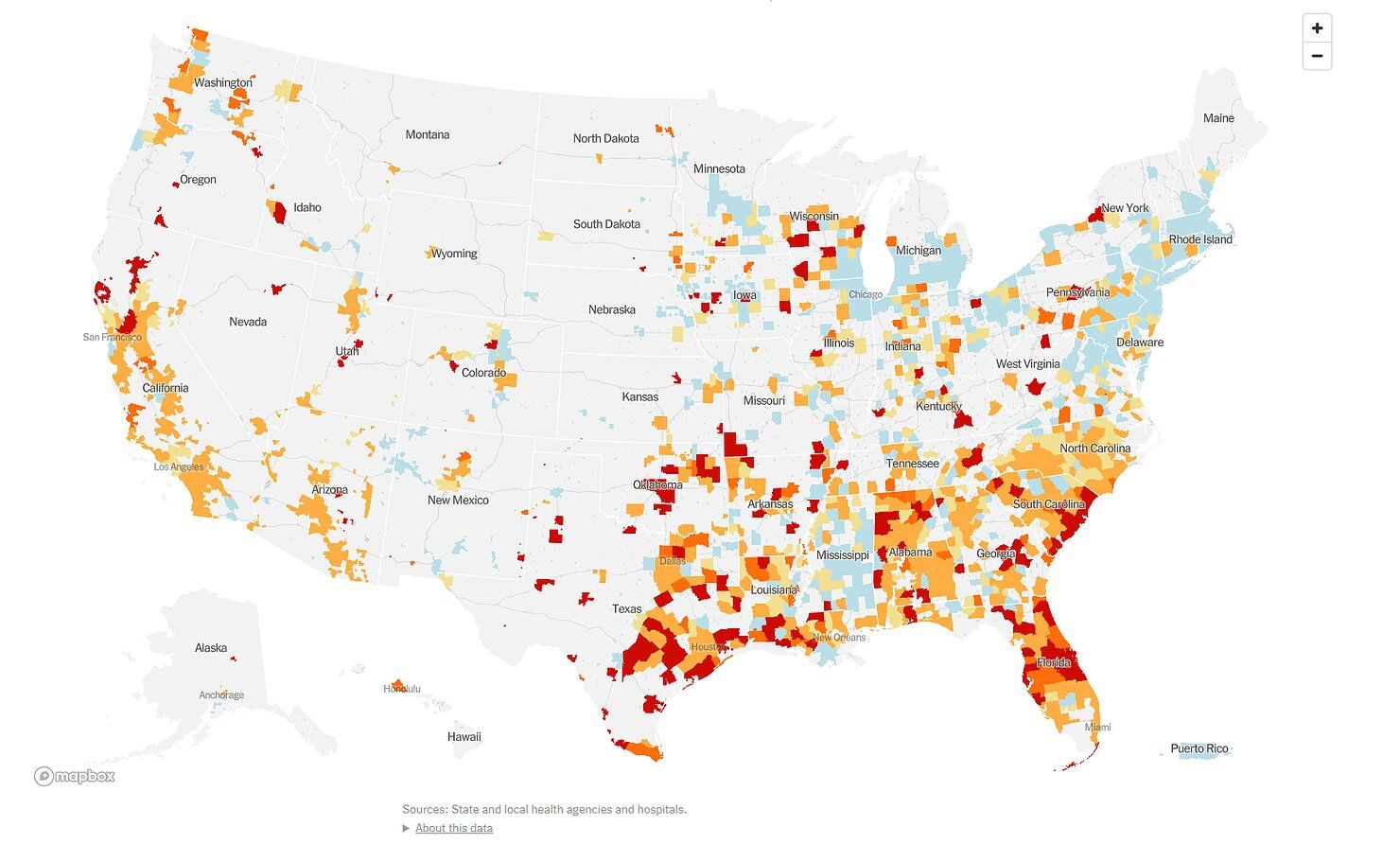

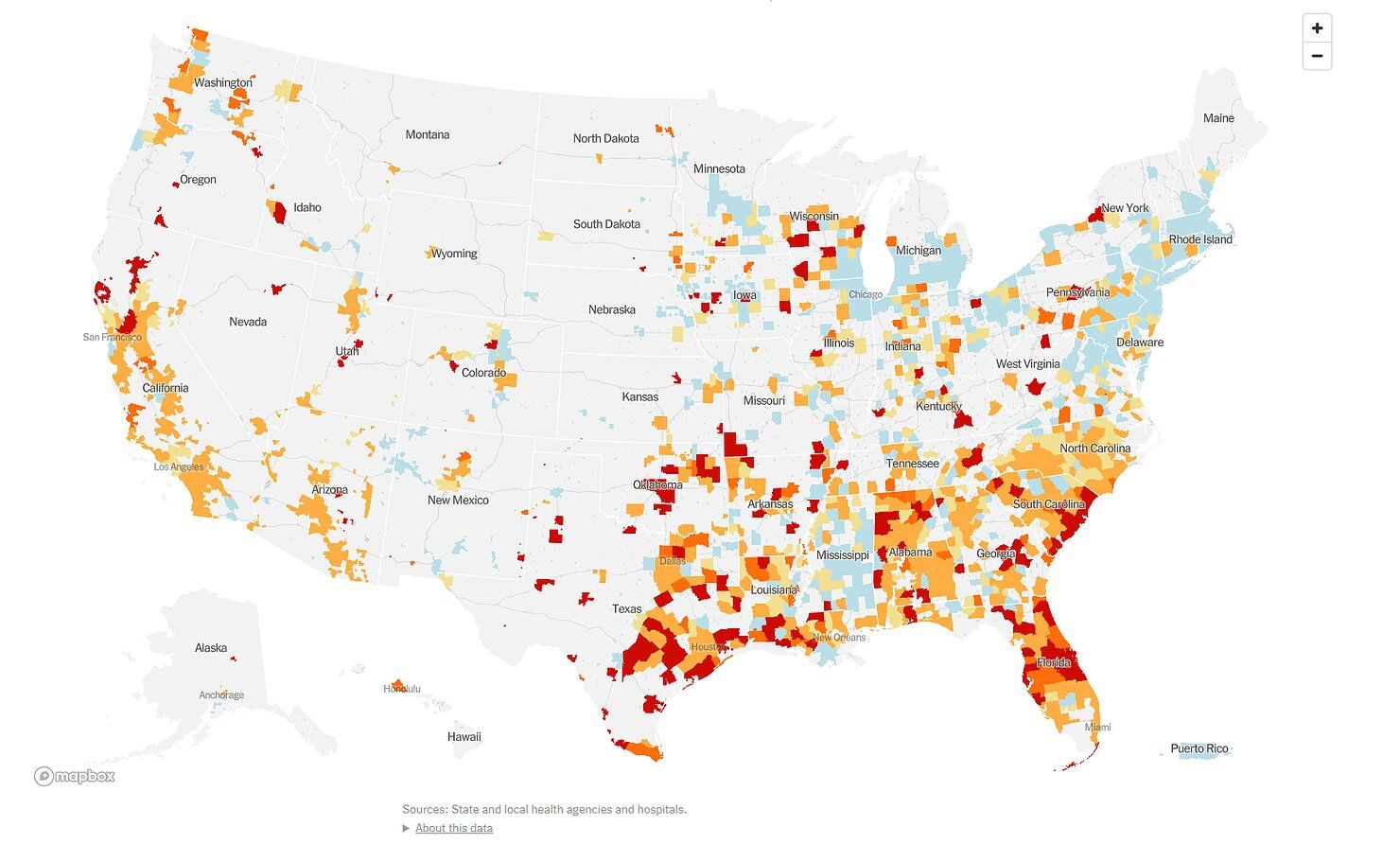

The market still remains wary of a second wave of coronavirus with nationwide cases in the US up 15% in the last two weeks and cases rising in 18 states across the South, West and Midwest, according to the NYT.

At the weekend, new cases in California rose by a record (4,515) and Florida infections up 3.7% from a day earlier, compared with an average increase of 3.5% in the previous seven days.

The market still remains wary of a second wave of coronavirus with nationwide cases in the US up 15% in the last two weeks and cases rising in 18 states across the South, West and Midwest, according to the NYT.

At the weekend, new cases in California rose by a record (4,515) and Florida infections up 3.7% from a day earlier, compared with an average increase of 3.5% in the previous seven days.

Last week, Apple said that it will again close almost a dozen stores in the US because of a recent rise in coronavirus infections in the South and West, and although the tech giant can still operate effectively online the move is an ominous sign for brick and mortar retailers across America and a dent to the optimism that the US recovery is in full swing.

A number of Fed officials also remain cautious with Fed's Rosengren (non-voter) stating on Friday “this lack of containment could ultimately lead to a need for more prolonged shut-downs, which result in reduced consumption and investment, and higher unemployment”, with Neel Kashkari (voter) adding “unfortunately, my base case scenario is that we will see a second wave of the virus across the US, probably this fall”.

Two other noteworthy developments on the virus come from Germany where the infection rate has shot up to its highest level for weeks after more than 1,300 abattoir employees tested positive for the virus. The country's R-rate stood at 2.88 on Sunday, from 1.06 on Friday. Meanwhile, China has blocked some US poultry imports over clusters at Tyson Foods plants.

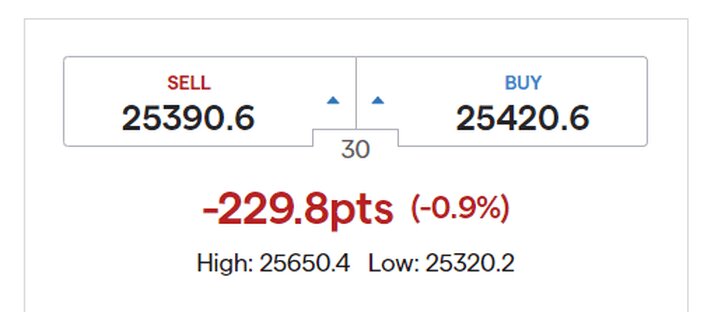

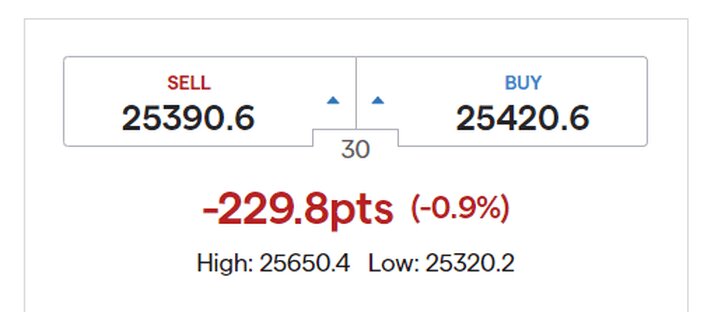

In summary, we can expect a gap down in US equity index futures at the re-opening of trade and some nervousness to kick off the week.

The weekend Dow via IG is currently down over 225 points.

A number of Fed officials also remain cautious with Fed's Rosengren (non-voter) stating on Friday “this lack of containment could ultimately lead to a need for more prolonged shut-downs, which result in reduced consumption and investment, and higher unemployment”, with Neel Kashkari (voter) adding “unfortunately, my base case scenario is that we will see a second wave of the virus across the US, probably this fall”.

Two other noteworthy developments on the virus come from Germany where the infection rate has shot up to its highest level for weeks after more than 1,300 abattoir employees tested positive for the virus. The country's R-rate stood at 2.88 on Sunday, from 1.06 on Friday. Meanwhile, China has blocked some US poultry imports over clusters at Tyson Foods plants.

In summary, we can expect a gap down in US equity index futures at the re-opening of trade and some nervousness to kick off the week.

The weekend Dow via IG is currently down over 225 points.

The shape of things to come

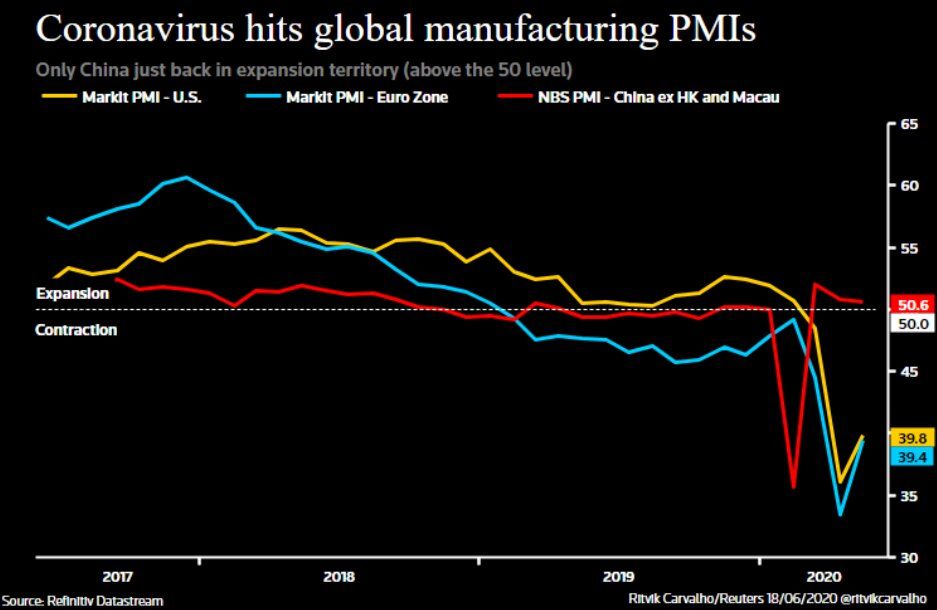

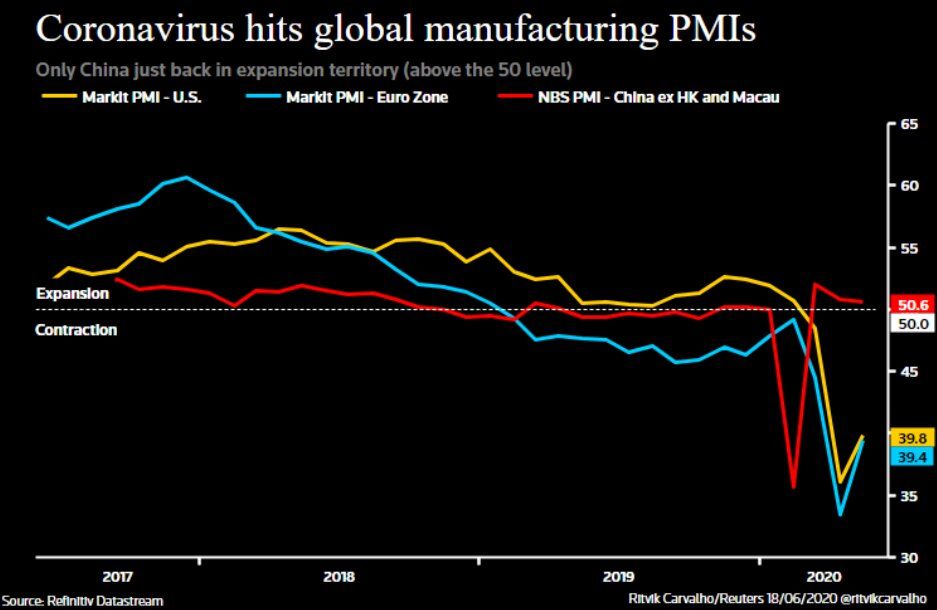

One of the most important data sets this week is the latest flash PMI data due on Tuesday. While a rising headline number may give some cheer that confidence is returning the data in itself is forward looking which brings about two interesting points.

1. It could be highly subject to change depending on the developments of a second wave virus (a la Apple on Friday).

2. As analysts at ING note, looking at other data, including Google's mobility index, the economy still appears to be operating well below its pre-virus level.

One of the most important data sets this week is the latest flash PMI data due on Tuesday. While a rising headline number may give some cheer that confidence is returning the data in itself is forward looking which brings about two interesting points.

1. It could be highly subject to change depending on the developments of a second wave virus (a la Apple on Friday).

2. As analysts at ING note, looking at other data, including Google's mobility index, the economy still appears to be operating well below its pre-virus level.

The latest in the UK

Britain will outline its plans to ease the coronavirus lockdown this week, health minister Matt Hancock said on Sunday, potentially relaxing the two-metre rule on social distancing, allowing many businesses to reopen in early July.

Meanwhile, the Sunday Times reported that Chancellor Rishi Sunak is planning an emergency VAT cut in the latest efforts to tackle economic fallout from the coronavirus outbreak. A similar move was delivered by the then Chancellor Alistair Darling in 2008 when a cut from 17.5% to 15% was in place for a period of 13 months. Three points on this are:

1. 15% is the floor for VAT as currently allowed by the EU which the UK are still bound to until the end of the year.

2. Some pushes within industry for cuts targeted in certain sectors that have been hit the hardest (hospitality).

3. The chancellor is also working on plans for deferred tax rises and cuts to public spending in an Autumn Budget.

At present, my fundamental view on GBP is moderately bearish. Despite some progression in re-opening the economy, and with promises of more stimulative measures mentioned above, for now the Bank of England remains somewhat reluctant to pull out the big guns and UK/EU trade negotiations remain far from conclusive.

Another spook to markets on COVID numbers this week would likely result in a flight to safety into the greenback, so for now my bias remains to the downside in GBP/USD.

WEEKLY TRADING SET-UPS FROM SAM NORTH

Senior trader and mentor Sam North provides a technical look at the charts and his set-ups for the week ahead.

Britain will outline its plans to ease the coronavirus lockdown this week, health minister Matt Hancock said on Sunday, potentially relaxing the two-metre rule on social distancing, allowing many businesses to reopen in early July.

Meanwhile, the Sunday Times reported that Chancellor Rishi Sunak is planning an emergency VAT cut in the latest efforts to tackle economic fallout from the coronavirus outbreak. A similar move was delivered by the then Chancellor Alistair Darling in 2008 when a cut from 17.5% to 15% was in place for a period of 13 months. Three points on this are:

1. 15% is the floor for VAT as currently allowed by the EU which the UK are still bound to until the end of the year.

2. Some pushes within industry for cuts targeted in certain sectors that have been hit the hardest (hospitality).

3. The chancellor is also working on plans for deferred tax rises and cuts to public spending in an Autumn Budget.

At present, my fundamental view on GBP is moderately bearish. Despite some progression in re-opening the economy, and with promises of more stimulative measures mentioned above, for now the Bank of England remains somewhat reluctant to pull out the big guns and UK/EU trade negotiations remain far from conclusive.

Another spook to markets on COVID numbers this week would likely result in a flight to safety into the greenback, so for now my bias remains to the downside in GBP/USD.

WEEKLY TRADING SET-UPS FROM SAM NORTH

Senior trader and mentor Sam North provides a technical look at the charts and his set-ups for the week ahead.

CALENDAR HIGHLIGHTS VIA @NEWSQUAWK

Monday

Tuesday

Wednesday

Thursday

Friday

Monday

- Data: EZ Consumer Confidence US Existing Home Sales

- Events: China LPR, US & Russian Army Talks; Chinese, Russian & Indian Foreign Minister meeting

- Speakers: ECB’s de Guindos & Lane, Fed’s Kashkari, RBA Lowe

Tuesday

- Data: EZ, UK & US PMIs (Flash)

- Supply: UK, German & US

Wednesday

- Data: German Ifo

- Events: RBNZ Rate Decision, BoJ Summary of Opinions

- Speakers: ECB’s Lane, Fed’s Evans & Bullard, EU Commission Draft 2021 Budget presentation

- Supply: UK, German & US

Thursday

- Data: German GfK, US Durable Goods, GDP (Final), PCE Prices (Final), Initial Jobless Claims

- Speakers: ECB’s Schnabel & Mersch, BoE’s Haldane

- Supply: US

Friday

- Data: Japanese CPI, US PCE Price Index, Personal Income & University of Michigan Sentiment (F)

- Speakers: ECB’s Schnabel

Start your training now on AmplifyNOW and gain access to 3 free sessions delivered by the directors of the company.

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.