MACRO MENU: 15 - 19 JUNE 2020

15 JUN 2020 | Careers

Amir Khadr - Head of Technology

What next for Wall Street?

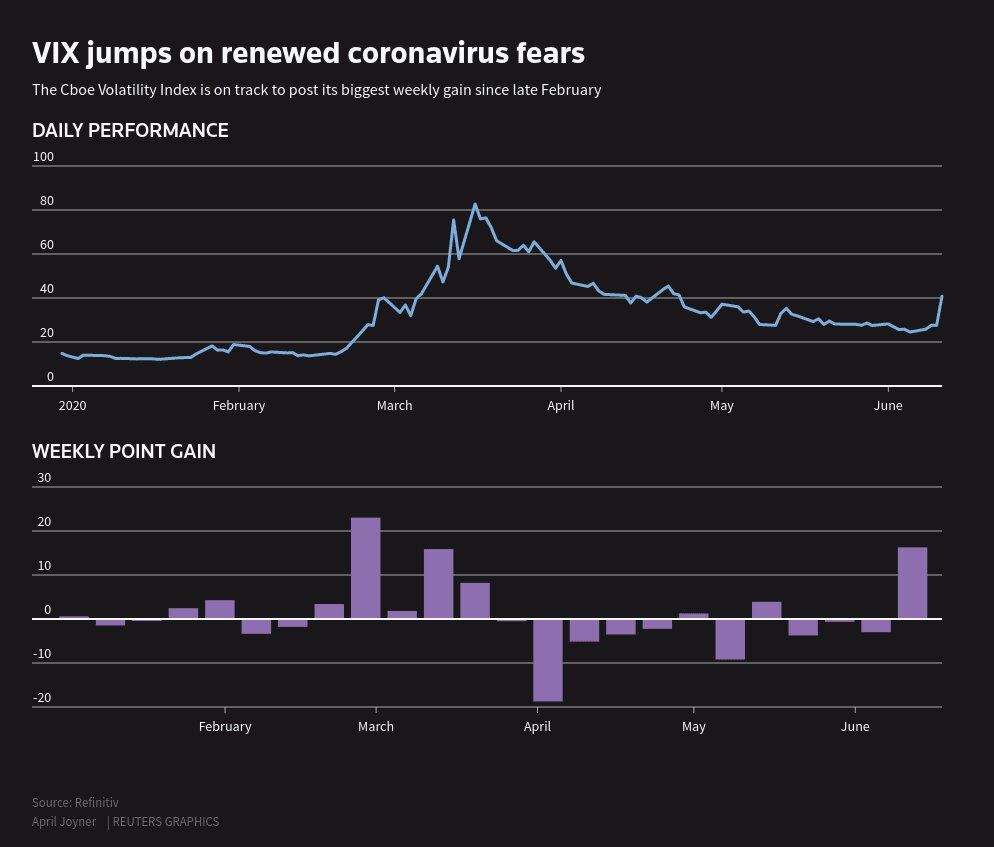

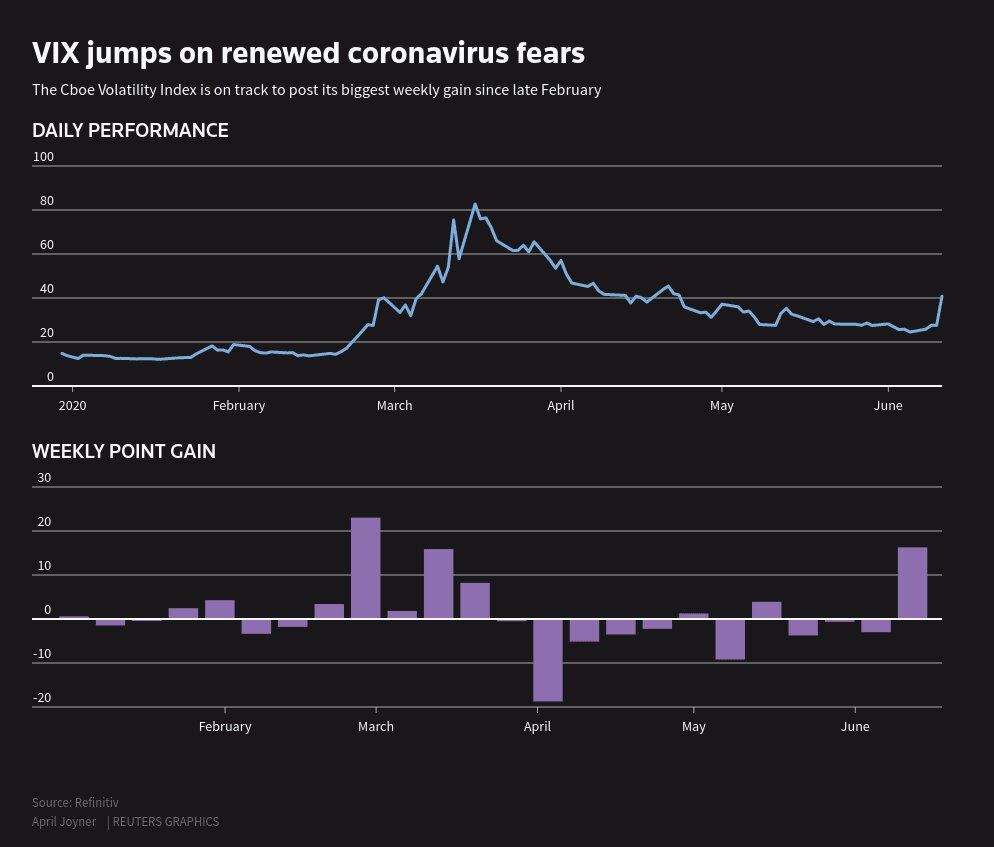

This is the main question on investors' minds this weekend. After a consistent multi-week drift lower in the Cboe volatility index (VIX), Thursday's sell-off saw a complete reversal, closing at its highest level since April 23rd as fears of a second wave of the virus took hold.

This is the main question on investors' minds this weekend. After a consistent multi-week drift lower in the Cboe volatility index (VIX), Thursday's sell-off saw a complete reversal, closing at its highest level since April 23rd as fears of a second wave of the virus took hold.

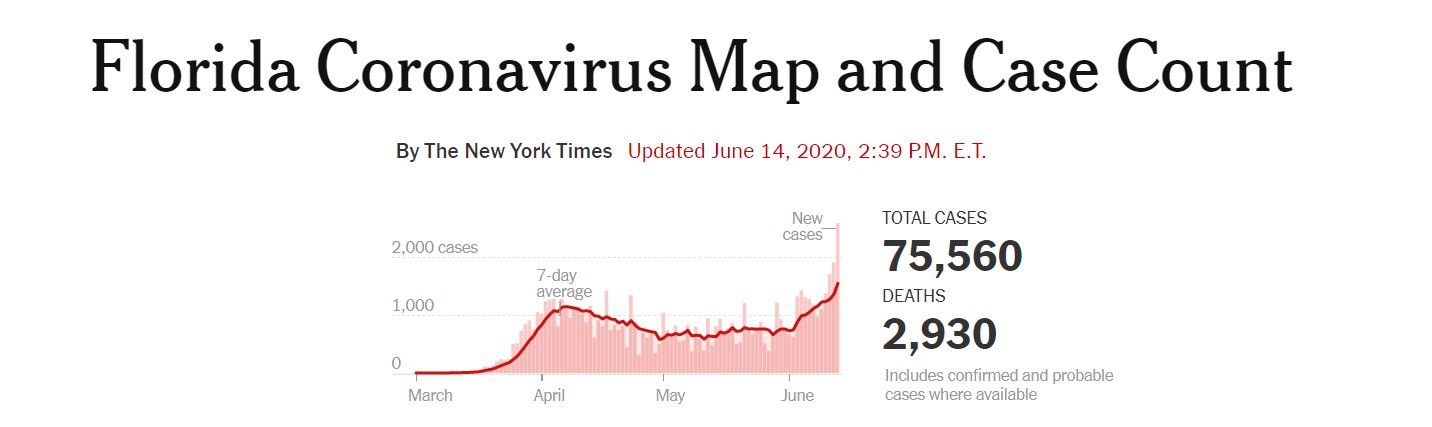

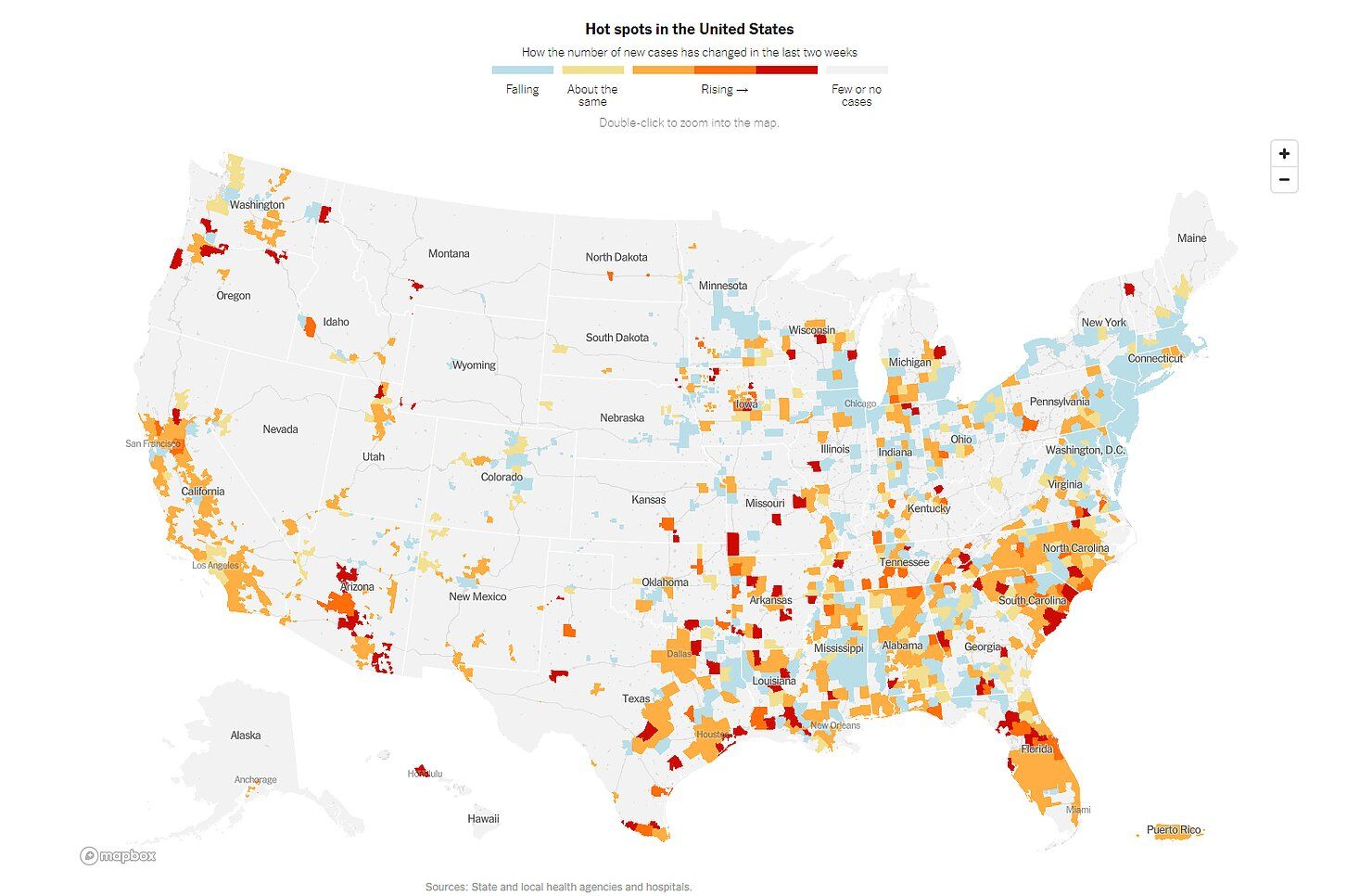

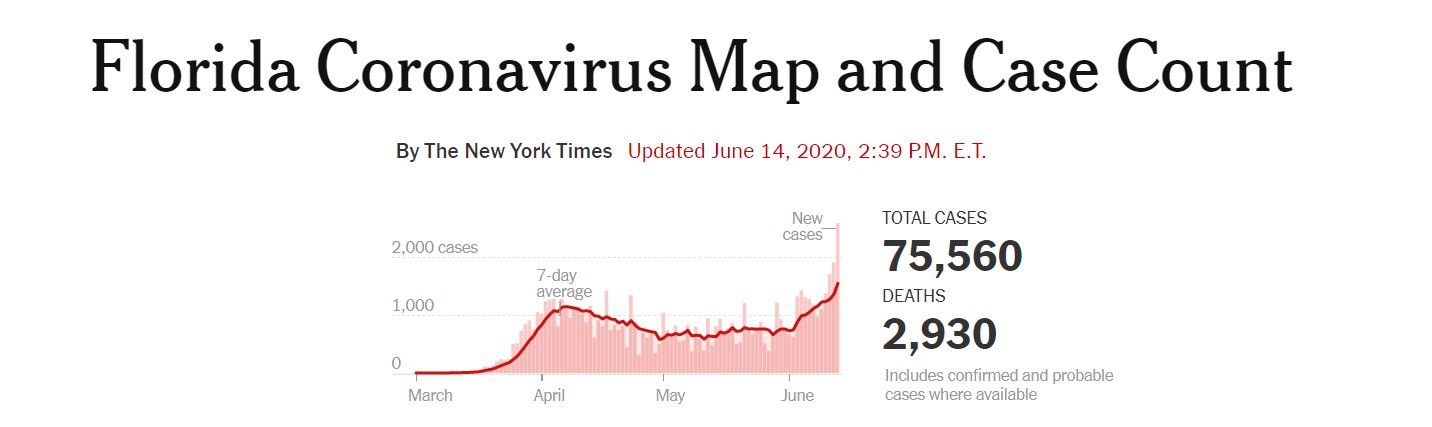

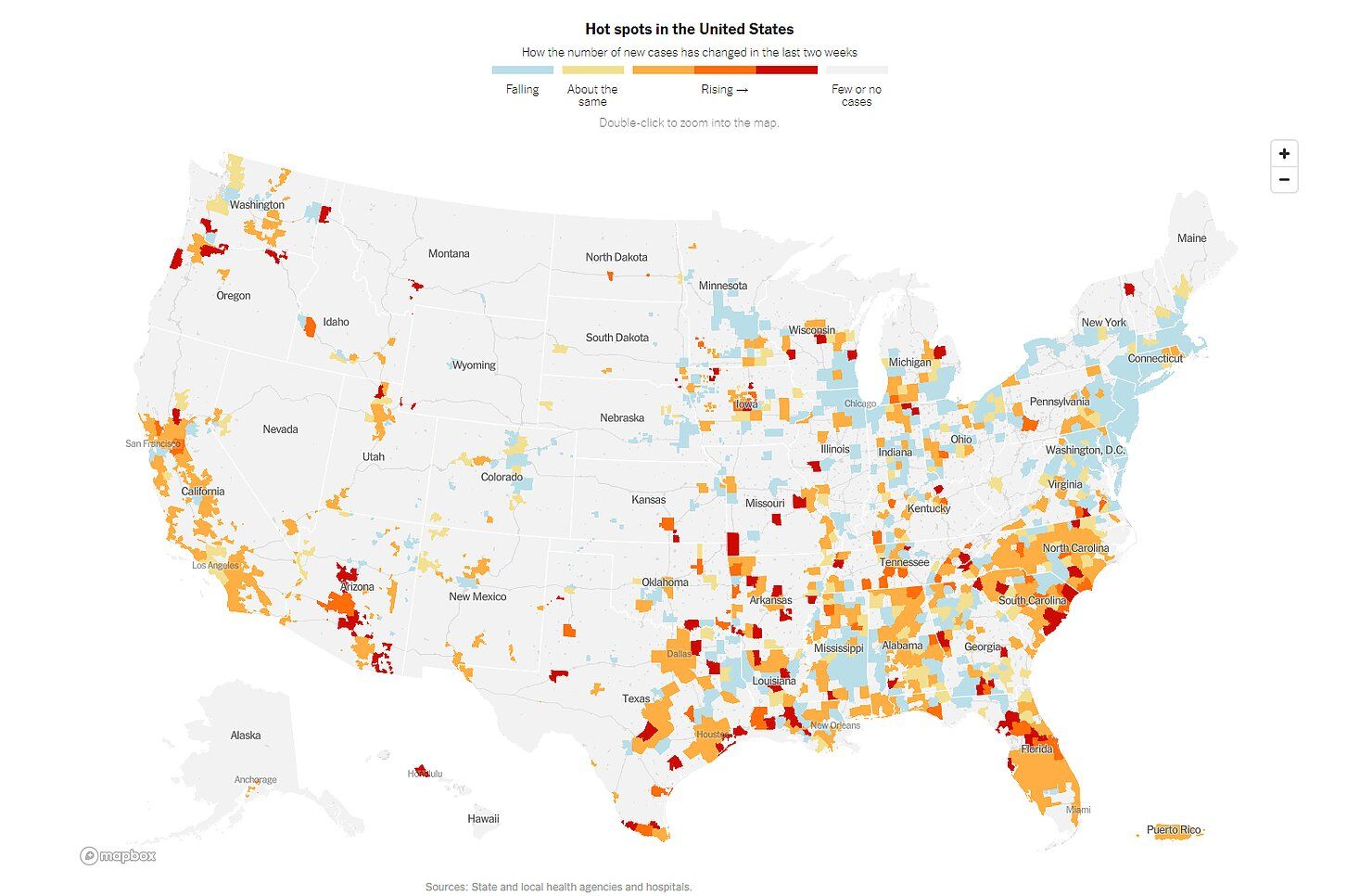

Given the main catalyst that caused the sell-off was the renewed rise in coronavirus cases in North America that is where my attention will remain this week. Florida, the state that saw the steepest curve of new infections reported 75,568 Covid-19 cases on Sunday, up 2.7% from a day earlier, compared with an average increase of 2.3% in the previous seven days. Other notable hotspots include North and South Carolina, Texas and Arizona.

Meanwhile in mainland China, Beijing took steps this weekend to close the city’s largest fruit and vegetable supply centre (Xinfadi market covers an area of 112 hectares and has some 1,500 management personnel and more than 4,000 tenants) and locked down nearby housing districts as dozens of people associated with the wholesale market tested positive for the coronavirus, according to Bloomberg.

Despite these latest developments my belief remains that stocks will once again find their feet and start the slow climb back higher. But last week's sell-off was a timely reminder for market participants not to become too complacent, and so we continue to monitor the trajectory of new cases with strong vigilance and willing to be flexible in adapting our short-term view upon the facts presented in incoming data.

Time to start delivering on your promises

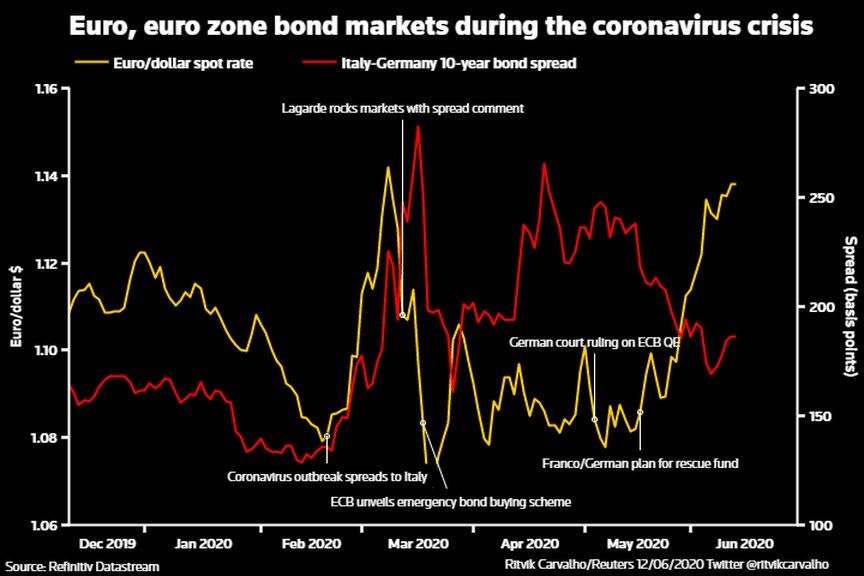

The EUR has had a solid innings of late. Whether it be Germany over delivering on their second stimulus package, the ECB topping market expectations with their QE top-up, or Europe finally finding common ground on a shared effort to counteract the pandemic, the single currency has prospered on the united response and general USD weakness.

Despite these latest developments my belief remains that stocks will once again find their feet and start the slow climb back higher. But last week's sell-off was a timely reminder for market participants not to become too complacent, and so we continue to monitor the trajectory of new cases with strong vigilance and willing to be flexible in adapting our short-term view upon the facts presented in incoming data.

Time to start delivering on your promises

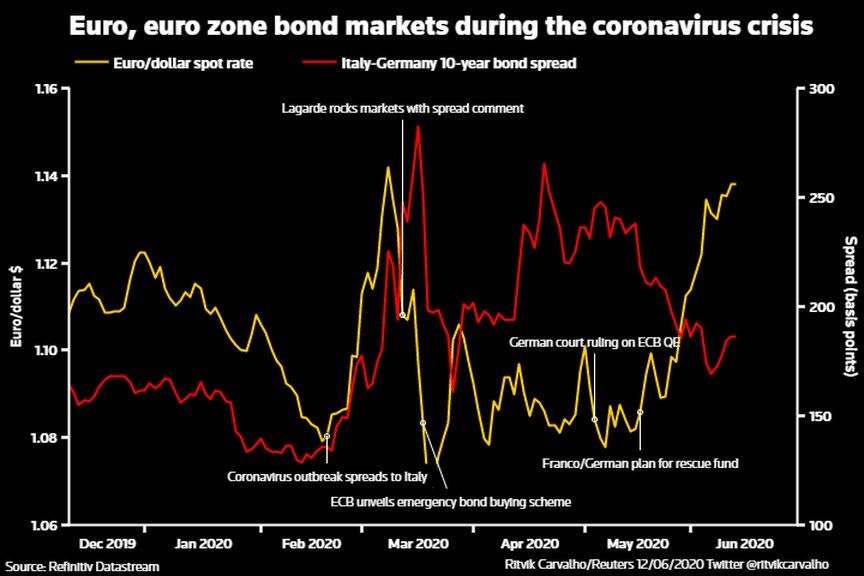

The EUR has had a solid innings of late. Whether it be Germany over delivering on their second stimulus package, the ECB topping market expectations with their QE top-up, or Europe finally finding common ground on a shared effort to counteract the pandemic, the single currency has prospered on the united response and general USD weakness.

This week eyes will turn to the EU leaders' meeting on Friday where the main topic of debate will be the bloc's budget and EUR 750bln recovery fund. At the time, a tentative agreement in principle saw the EUR rally but now ideas need to become solid facts and figures.

For the proposal to succeed it requires unanimous approval but resistance is likely to remain from the "frugal four" (Netherlands, Austria, Denmark, Sweden). An inability to strike an accord to push the programme forward this summer puts Southern European bonds at risk with the IT/GE 10-yr yield spread ripe for a reversal of the tightening seen over the last six weeks.

For the proposal to succeed it requires unanimous approval but resistance is likely to remain from the "frugal four" (Netherlands, Austria, Denmark, Sweden). An inability to strike an accord to push the programme forward this summer puts Southern European bonds at risk with the IT/GE 10-yr yield spread ripe for a reversal of the tightening seen over the last six weeks.

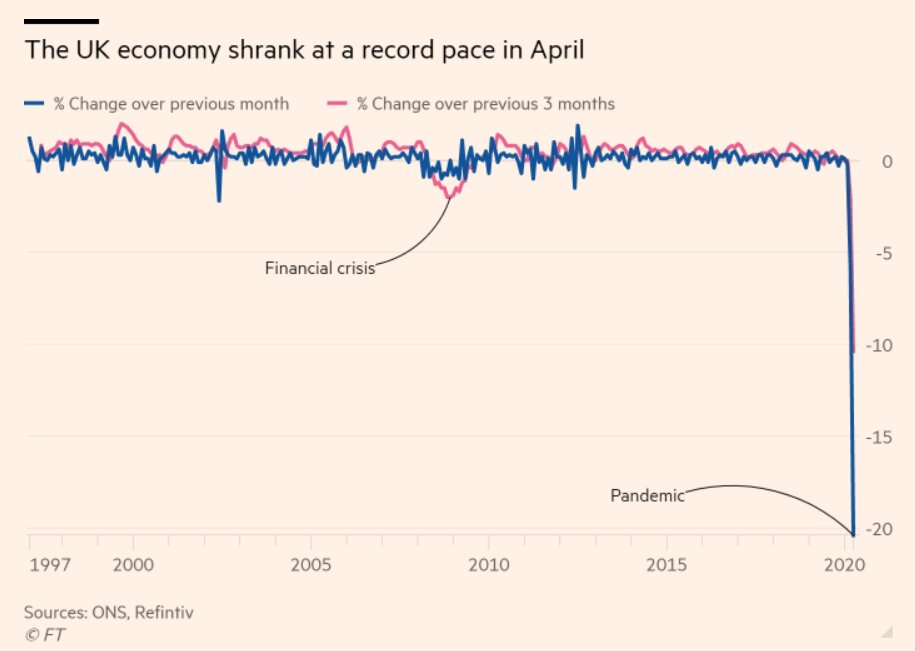

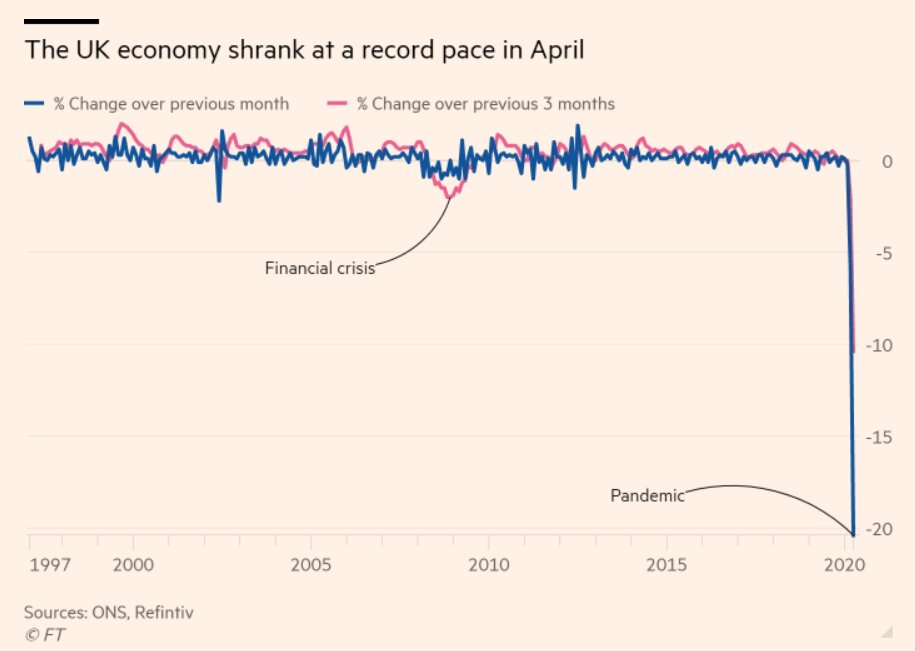

Bank of England set to pull the QE trigger once again

Last week, the UK economy shrunk by a quarter with output falling at the fastest monthly rate on record. “April’s fall in GDP is the biggest the UK has ever seen, more than three times larger than last month and almost 10 times larger than the steepest pre-Covid-19 fall,” said Jonathan Athow, deputy national statistician for economic statistics at the ONS.\

Last week, the UK economy shrunk by a quarter with output falling at the fastest monthly rate on record. “April’s fall in GDP is the biggest the UK has ever seen, more than three times larger than last month and almost 10 times larger than the steepest pre-Covid-19 fall,” said Jonathan Athow, deputy national statistician for economic statistics at the ONS.\

As such, expectations are high that the Bank needs to step up its quantitative easing (QE) programme to further assist the economic recovery with Governor Andrew Bailey stating last week that he will be "ready to take action".

George Buckley, an economist at Nomura, said the BoE is likely to add an extra GBP 150bln to its QE scheme, giving policymakers breathing space to monitor the economic recovery in the UK. This means that come Thursday's meeting, anything less will likely be met in disappointing fashion.

Separately, UK Prime Minister Boris Johnson and EU Commission President Von der Leyen are set to hold talks on Monday. Reports in the UK press this weekend suggest the PM will attempt to bring urgency to Brexit talks by warning both sides are heading for No Deal if the pace of negotiations is not accelerated immediately.

Come on Jay, give us a smile!

George Buckley, an economist at Nomura, said the BoE is likely to add an extra GBP 150bln to its QE scheme, giving policymakers breathing space to monitor the economic recovery in the UK. This means that come Thursday's meeting, anything less will likely be met in disappointing fashion.

Separately, UK Prime Minister Boris Johnson and EU Commission President Von der Leyen are set to hold talks on Monday. Reports in the UK press this weekend suggest the PM will attempt to bring urgency to Brexit talks by warning both sides are heading for No Deal if the pace of negotiations is not accelerated immediately.

Come on Jay, give us a smile!

White House economic adviser Larry Kudlow was the next in line to take a pop at the Fed Chair suggesting Jerome Powell ought to "lighten up", while suggesting the US economy is on track for 20% growth in 2H20 with a jobless rate below 10%.

White House Advisor

Unfortunately for Powell this is not the last he's likely to hear of it, as he is set to testify via video conference on Tuesday before the Senate Banking Committee and to the House Financial Services Committee the day after.

In years gone by, the semi-annual testimony has acted as a key platform for the Fed Chair to communicate thoughts on current conditions and future expectations but given the delivery of the latest Fed statement and Summary of Economic Projections (SEP) last week, I do not anticipate anything market moving.

WEEKLY TRADING SET-UPS FROM SAM NORTH

Senior trader and mentor Sam North provides a technical look at the charts and his set-ups for the week ahead.+

White House Advisor

Unfortunately for Powell this is not the last he's likely to hear of it, as he is set to testify via video conference on Tuesday before the Senate Banking Committee and to the House Financial Services Committee the day after.

In years gone by, the semi-annual testimony has acted as a key platform for the Fed Chair to communicate thoughts on current conditions and future expectations but given the delivery of the latest Fed statement and Summary of Economic Projections (SEP) last week, I do not anticipate anything market moving.

WEEKLY TRADING SET-UPS FROM SAM NORTH

Senior trader and mentor Sam North provides a technical look at the charts and his set-ups for the week ahead.+

Supply: UK, German & USCALENDAR HIGHLIGHTS VIA @NEWSQUAWK

Monday

Tuesday

Wednesday

Thursday

Friday

Monday

- Data: Chinese Retail Sales, Industrial Output & US NY Fed Manufacturing

- Event: UK PM Johnson & EU Commission President Von Der Leyen meeting

- Speakers: Fed’s Kaplan

Tuesday

- Data: German CPI (Final) & ZEW, UK Unemployment, US Retail Sales, Industrial Production & Manufacturing Output

- Event: BoJ Rate Decision

- Speakers: Fed Chair Powell Testimony To Senate Banking Committee

- Supply: UK

Wednesday

- Data: Japanese Export/Imports, UK, EZ & Canadian CPI, EZ CPI, US Building Permits & Housing Starts, New Zealand GDP

- Event: OPEC Monthly Oil Market Report

- Speakers: Fed Chair Powell Testimony to House Committee On Financial Services, Mester, ECB’s de Guindos & Mersch

- Supply: UK, German & US

Thursday

- Data: Australian Employment, US Initial Jobless Claims & Philadelphia Fed Business Index

- Event: SNB, Norges Bank & BoE Rate Decisions, JMMC Meeting

- Speakers: ECB’s de Guindos, BoE’s Broadbent & Tenreyro

- Supply: Spain, France, US, ECB TLTRO

Friday

- Data: Japanese CPI, German Producer Prices, UK Retail Sales

- Event: CBR Rate Decision, European Council Video Conference

- Speakers: Fed Chair Powell & Rosengren

- Expiries: Quadruple Witching

Follow me on Twitter @AWMCheung for daily insights and commentary.

Check out www.amplifytrading.com to find out further information about our trader and student training programmes.

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.