MACRO MENU: 11 - 15 MAY 2020

11 MAY 2020 | Careers

Amir Khadr - Head of Technology

MARKET BRIEFING: Monday 11th May 2020

THE WEEK AHEAD: Sunday 10th May 2020

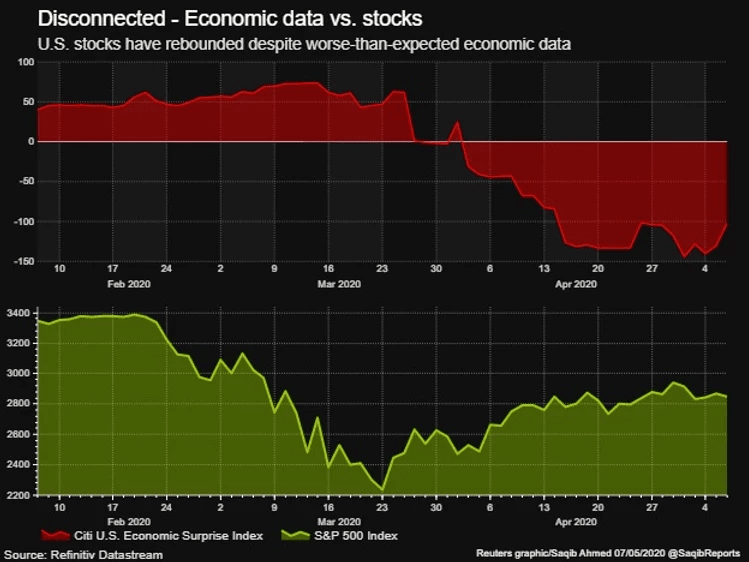

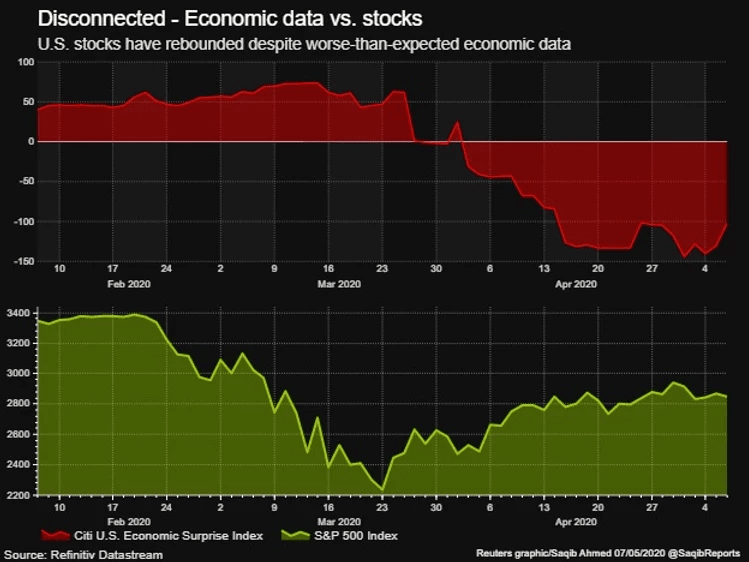

THE DISCONNECT BETWEEN MAIN STREET AND WALL STREET

THE DISCONNECT BETWEEN MAIN STREET AND WALL STREET

Last Friday saw 20.5mln US jobs lost in the month of April, wiping out a decade of job growth and yet stocks rallied. That statement really says it all about financial markets in the current context.

This week we could see this pattern continue as US Retail Sales are expected to fall 10% in April, exceeding the record 8.4% decline seen in March and Industrial Production is anticipated to fall over 11.5%. However, these economically shocking numbers are likely to be superseded by the anticipation of the gradual lifting of lockdown measures around the world as governments look to resuscitate their domestic economies.

This week we could see this pattern continue as US Retail Sales are expected to fall 10% in April, exceeding the record 8.4% decline seen in March and Industrial Production is anticipated to fall over 11.5%. However, these economically shocking numbers are likely to be superseded by the anticipation of the gradual lifting of lockdown measures around the world as governments look to resuscitate their domestic economies.

France, Spain, Denmark, Norway and the UK will all lift some measures. For those that missed the PM's speech this evening and are based in the UK, his statement can be summed up in the following three phases:

I don't anticipate markets to be particularly moved by what was said as a cautious approach was always likely going to be the way forward and new COVID-19 outbreaks in South Korea, China and Germany this weekend have highlighted the challenges to come if the loosening of lockdown is not managed in the appropriate way.

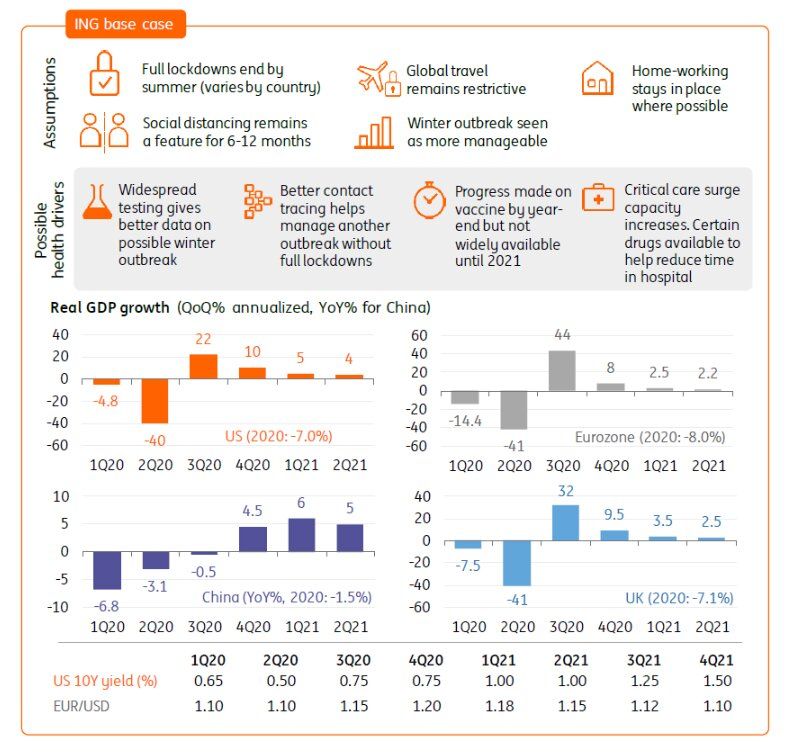

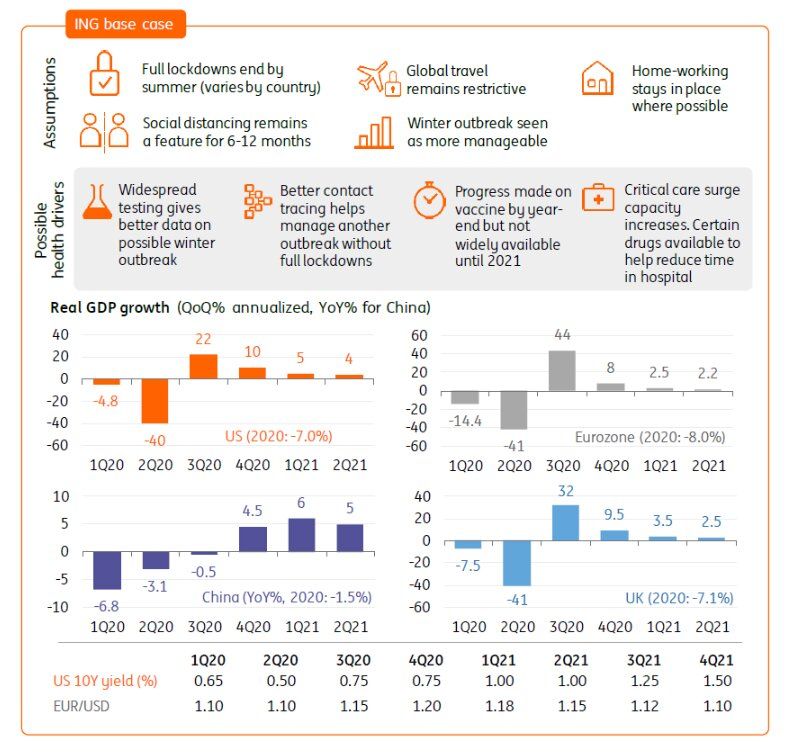

Here's a great graphic via ING on their three COVID-19 scenarios:

-

From Monday actively encouraging people to go to work if they can't work from home (construction, manufacturing etc). From Weds - unlimited exercise, sitting in parks, playing sports with family, can drive to locations

-

From earliest June 1st phased reopening of some shops and primary schools - starting with Reception, Year 1 and Year 6. Aim is for secondary pupils with exams next year to have some time with teachers before holidays

-

By July at earliest hoping to open some of hospitality industry and other public places provided they are safe

I don't anticipate markets to be particularly moved by what was said as a cautious approach was always likely going to be the way forward and new COVID-19 outbreaks in South Korea, China and Germany this weekend have highlighted the challenges to come if the loosening of lockdown is not managed in the appropriate way.

Here's a great graphic via ING on their three COVID-19 scenarios:

WHITE HOUSE CONSIDERS MORE STIMULUS

Treasury Secretary Steven Mnuchin was quoted on Sunday saying that the "staggering US unemployment rate reported by the government on Friday amid coronavirus lockdowns may get even worse" and the White House has started informal talks with Republicans and Democrats in Congress about next steps on coronavirus relief legislation, according to Reuters.

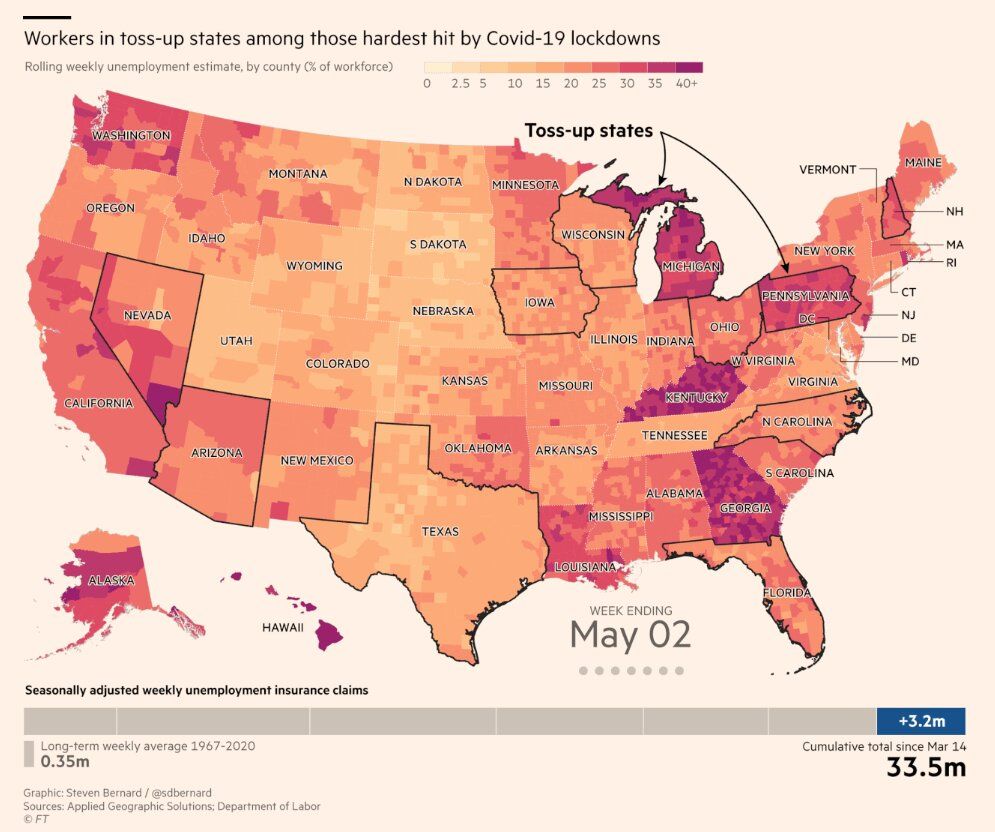

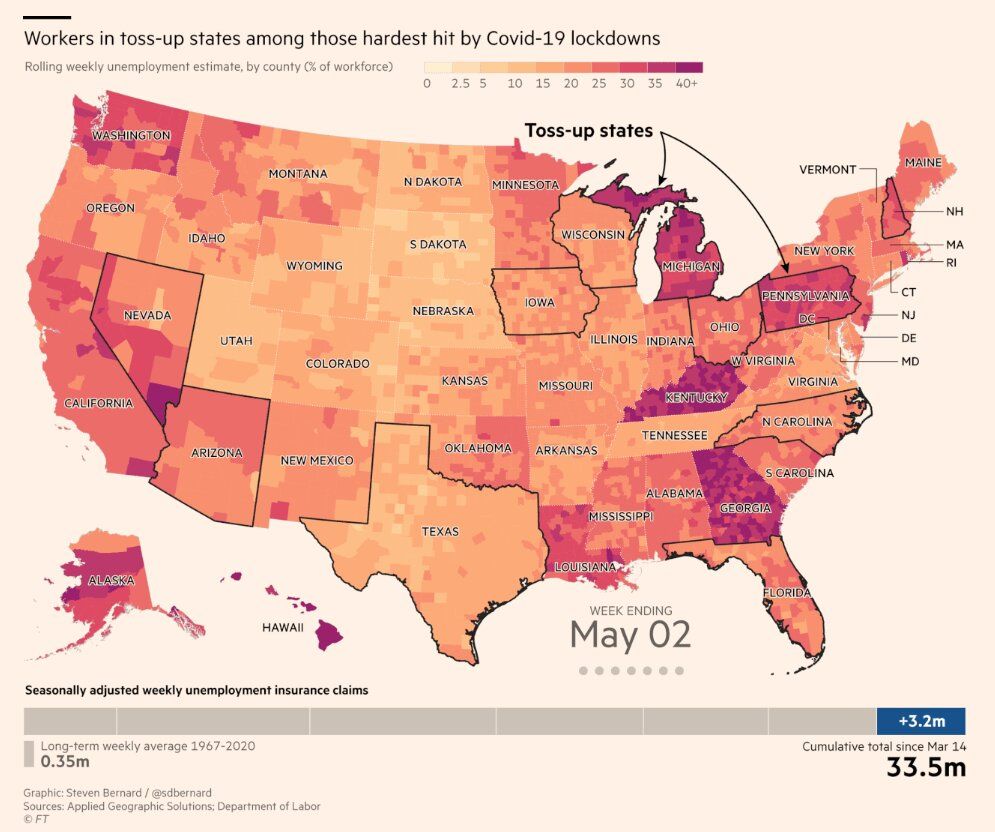

An interesting graphic via the FT shows Michigan, Pennsylvania and Nevada are considered key battleground states that Trump and Biden need to secure in order to win the presidency later this year — and they have been among the hardest hit when looking at weekly unemployment claims.

Treasury Secretary Steven Mnuchin was quoted on Sunday saying that the "staggering US unemployment rate reported by the government on Friday amid coronavirus lockdowns may get even worse" and the White House has started informal talks with Republicans and Democrats in Congress about next steps on coronavirus relief legislation, according to Reuters.

An interesting graphic via the FT shows Michigan, Pennsylvania and Nevada are considered key battleground states that Trump and Biden need to secure in order to win the presidency later this year — and they have been among the hardest hit when looking at weekly unemployment claims.

NEGATIVE RATES IN THE US?

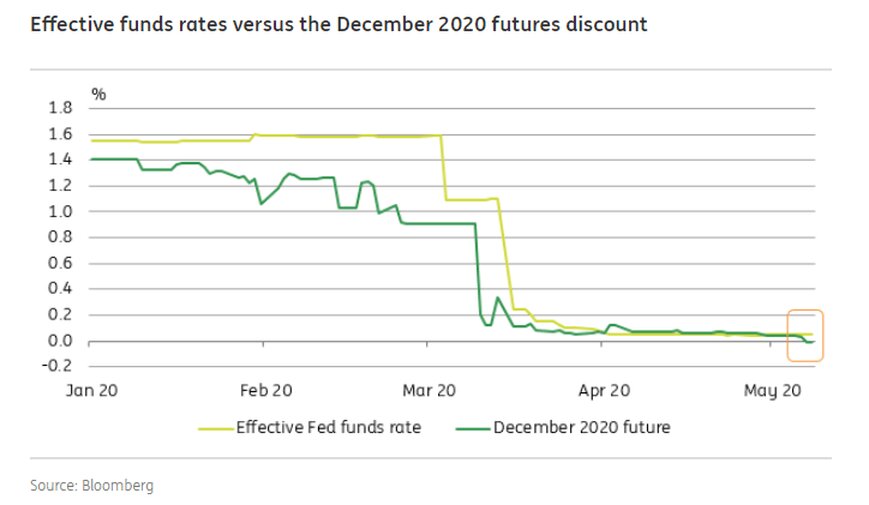

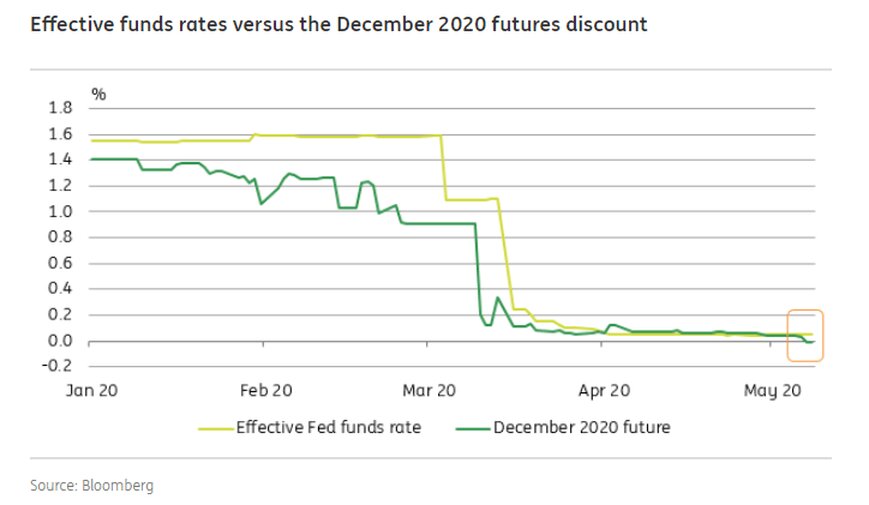

At the end of last week something important happened. US future rates moved into negative territory for the first time. According to ING, the profile shows negative rates taking hold from the end of 2020, then hitting the deepest negative by mid-2021, and subsequently returning to positive territory by early 2022.

At the end of last week something important happened. US future rates moved into negative territory for the first time. According to ING, the profile shows negative rates taking hold from the end of 2020, then hitting the deepest negative by mid-2021, and subsequently returning to positive territory by early 2022.

For those not familiar with how this all works, in short, negative rates would punish banks for leaving excess cash with the central bank and thus forcing them to lend which in turn boosts business investment and consumer spending. Read the full explainer HERE.

Although last week's development is symbolic, most of the bank reports I've read this weekend seem to suggest the actual implementation of negative rates by the Federal Reserve is highly unlikely given the disappointing performance in Japan and the Euro-zone and with better economic bang for your buck coming via fiscal expansion.

Nonetheless, Fed Chair Jerome Powell is scheduled to deliver a speech on 'current economic issues' at the Peterson Institute for International Economics this Wednesday which will be one of the main events for the week (full Fed speaker in calendar highlights).

THE EU STRIKES BACK

The European Commission could open a legal case against Germany over a ruling by the country’s constitutional court that the European Central Bank had overstepped its mandate with bond purchases, the EU executive arm said on Sunday. This comes after a German court in Karlsruhe last Tuesday gave the ECB three months to justify its flagship Euro-zone stimulus scheme or said the Bundesbank might have to quit it.

When I tweeted this headline on Saturday I had quite the vocal response on people's thoughts on the longevity of the Euro but from a market point of view I don't think it's a big deal for the immediate future. I base this on the regular legal process on when being the recipient of such demands as we saw last week and that the EU need to adopt a firm stance to discourage other national courts doing the same.

CALENDAR HIGHLIGHTS

Monday: JN BoJ Summary of Opinions, IT Industrial Production, US CB Employment Trends Index, 3-yr Auction, Fed's Bostic Speaks

Tuesday: JN Leading Index, 10-yr Auction, CN CPI/PPI, AU NAB Business Confidence, US CPI, Real Earnings, NFIB Small Business Optimism, WASDE Report, 10-yr Auction, Federal Budget Balance, Weekly API Inventories, 10-yr Auction Fed's Harker, Quarles, Mester, Bullard, Kashkari to Speak

Wednesday: JN Bank Lending, Current Account, Economy Watchers Current Index, AU RBNZ Interest Rate Decision (0.25%), Press Conference, AU Westpac Consumer Sentiment, Wage Price Index, IT 3/7/30-yr Auction, GE 30-yr Auction, EU Industrial Production, UK Q1 GDP (P), Business Investment, Construction Output, Industrial/Manufacturing Production, Trade Balance, NIESR GDP Estimate (tentative), US PPI, Weekly DoE Inventories, 30-yr Auction, WR OPEC Monthly Report, Fed's Powell Discusses Current Economic Conditions

Thursday: JN M2/M3 Money Supply, Machine Tool Orders, 30-yr Auction, AU Employment Chance, Unemployment Rate, NZ MI Inflation Expectations, Budget Balance, FR Unemployment Rate, Trade Balance, SP/GE CPI, UK 10-yr Auction, US Weekly Jobless Claims, Import/Export Price Index, CA Manufacturing Sales, BoC Financial System Review, BoC Poloz Speaks, Fed's Kashkari, Kaplan Speak

Friday: JN PPI, CN Industrial Production, Retail Sales, Unemployment Rate, Fixed Asset Investment, IT Industrial Sales/New Orders, CPI, FR CPI, GE GDP, PPI, EU GDP, Employment Change, Trade Balance, US Retail Sales, NY Empire Manufacturing Index, Industrial/Manufacturing Production, JOLTs Job Openings, Michigan Consumer Sentiment, Baker Hughes Rig Count, TIC data

You can find out more information about Amplify Trading HERE.

Have a good week ahead and stay safe.

Anthony Cheung

Head of Market Analysis

(@AWMCheung)

Although last week's development is symbolic, most of the bank reports I've read this weekend seem to suggest the actual implementation of negative rates by the Federal Reserve is highly unlikely given the disappointing performance in Japan and the Euro-zone and with better economic bang for your buck coming via fiscal expansion.

Nonetheless, Fed Chair Jerome Powell is scheduled to deliver a speech on 'current economic issues' at the Peterson Institute for International Economics this Wednesday which will be one of the main events for the week (full Fed speaker in calendar highlights).

THE EU STRIKES BACK

The European Commission could open a legal case against Germany over a ruling by the country’s constitutional court that the European Central Bank had overstepped its mandate with bond purchases, the EU executive arm said on Sunday. This comes after a German court in Karlsruhe last Tuesday gave the ECB three months to justify its flagship Euro-zone stimulus scheme or said the Bundesbank might have to quit it.

When I tweeted this headline on Saturday I had quite the vocal response on people's thoughts on the longevity of the Euro but from a market point of view I don't think it's a big deal for the immediate future. I base this on the regular legal process on when being the recipient of such demands as we saw last week and that the EU need to adopt a firm stance to discourage other national courts doing the same.

CALENDAR HIGHLIGHTS

Monday: JN BoJ Summary of Opinions, IT Industrial Production, US CB Employment Trends Index, 3-yr Auction, Fed's Bostic Speaks

Tuesday: JN Leading Index, 10-yr Auction, CN CPI/PPI, AU NAB Business Confidence, US CPI, Real Earnings, NFIB Small Business Optimism, WASDE Report, 10-yr Auction, Federal Budget Balance, Weekly API Inventories, 10-yr Auction Fed's Harker, Quarles, Mester, Bullard, Kashkari to Speak

Wednesday: JN Bank Lending, Current Account, Economy Watchers Current Index, AU RBNZ Interest Rate Decision (0.25%), Press Conference, AU Westpac Consumer Sentiment, Wage Price Index, IT 3/7/30-yr Auction, GE 30-yr Auction, EU Industrial Production, UK Q1 GDP (P), Business Investment, Construction Output, Industrial/Manufacturing Production, Trade Balance, NIESR GDP Estimate (tentative), US PPI, Weekly DoE Inventories, 30-yr Auction, WR OPEC Monthly Report, Fed's Powell Discusses Current Economic Conditions

Thursday: JN M2/M3 Money Supply, Machine Tool Orders, 30-yr Auction, AU Employment Chance, Unemployment Rate, NZ MI Inflation Expectations, Budget Balance, FR Unemployment Rate, Trade Balance, SP/GE CPI, UK 10-yr Auction, US Weekly Jobless Claims, Import/Export Price Index, CA Manufacturing Sales, BoC Financial System Review, BoC Poloz Speaks, Fed's Kashkari, Kaplan Speak

Friday: JN PPI, CN Industrial Production, Retail Sales, Unemployment Rate, Fixed Asset Investment, IT Industrial Sales/New Orders, CPI, FR CPI, GE GDP, PPI, EU GDP, Employment Change, Trade Balance, US Retail Sales, NY Empire Manufacturing Index, Industrial/Manufacturing Production, JOLTs Job Openings, Michigan Consumer Sentiment, Baker Hughes Rig Count, TIC data

You can find out more information about Amplify Trading HERE.

Have a good week ahead and stay safe.

Anthony Cheung

Head of Market Analysis

(@AWMCheung)

The Market Maker daily

e-newsletter and weekly podcast

99% said it helped them gain better knowledge of markets

99% said it helped them gain better knowledge of markets  70% said it helped them prepare for a job interview

70% said it helped them prepare for a job interview  Top 5% most followed podcasts globally

Top 5% most followed podcasts globally  Top 5% most shared globally in 2022

Top 5% most shared globally in 2022  Listened to in 84 countries world-wide

Listened to in 84 countries world-wide

Useful Links

EMPLOYERS

UNIVERSITIES

Contact

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.

Useful Links

STUDENTS

EMPLOYERS

UNIVERSITIES

Contact

-

Amplify Trading, 18 St Swithlin’s Ln, London EC4N 8AD

-

+44 (0) 203 372 8415

+44 (0) 203 372 8415

-

info@amplifyme.com

info@amplifyme.com

© Amplify Trading LTD (REG NO: 06798566) VAT: GB947568566. Registered England and Wales.